Question: Step by step solution would be appreciated for each part thanks You are given the following information regarding the current domestic government bond market: Bond

Step by step solution would be appreciated for each part thanks

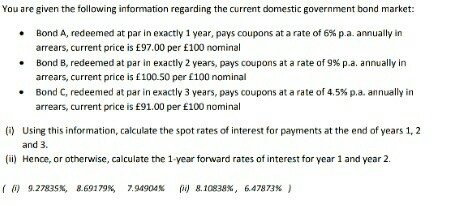

You are given the following information regarding the current domestic government bond market: Bond A, redeemed at par in exactly 1 year, pays coupons at a rate of 6% pa. annually in arrears, current price is E97.00 per 100 nominal Bond B, redeemed at par in exactly 2 years, pays coupons at a rate of g% pa, annually in arrears, current price is E100.50 per E100 nominal Bond C, redeemed at par in exactly 3 years, pays coupons at a rate of 4.5% pa. annually in arrears, current price is E91.00 per 100 nominal * . (i) (ii) ( Using this information, calculate the spot rates of interest for payments at the end of years 1, 2 and 3. Hence, or otherwise, calculate the 1-year forward rates of interest for year 1 and year 2. 6) 9.27835%, 8.69179%, 7.94904% (ii) 8.10838% , 647873% )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts