Question: Step by step solution would be grateful thanks for part a and b with answers thanks Tweed Ltd discloses the following accounting extracts for Ye-20X9

Step by step solution would be grateful thanks for part a and b with answers thanks

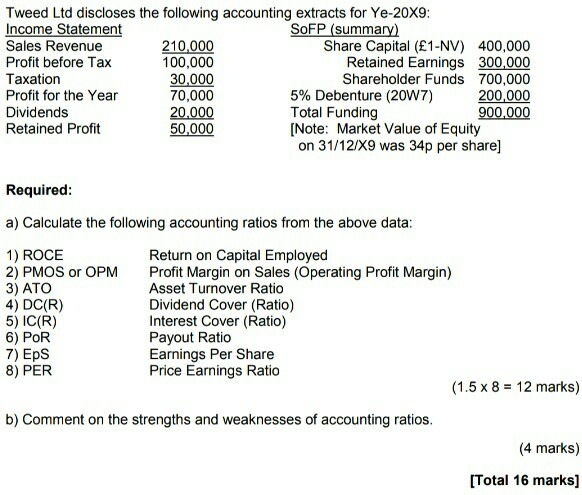

Tweed Ltd discloses the following accounting extracts for Ye-20X9 Income Statement Sales Revenue Profit before Tax Taxation Profit for the Year Dividend:s Retained Profit OFP (summa 210,000 100,000 30,000 70,000 20000 50,000 Share Capital (1-NV) 400,000 Retained Earnings 300,000 Shareholder Funds 700,000 5% Debenture (20W7) 200000 900,000 Total Funding [Note: Market Value of Equity on 31/12/x9 was 34p per share] Required a) Calculate the following accounting ratios from the above data 1) ROCE 2) PMOS or OPM 3) ATO 4) DC(R) 5) IC(R) 6) PoR 7) EpS 8) PER Return on Capital Employed Profit Margin on Sales (Operating Profit Margin) Asset Turnover Ratio Dividend Cover (Ratio) Interest Cover (Ratio) Payout Ratio Earnings Per Share Price Earnings Ratio (1.5 x 8 12 marks) b) Comment on the strengths and weaknesses of accounting ratios (4 marks) [Total 16 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts