Question: step by step solution You are responsible for managing a portfolio of two investments for the coming year. You have read all of the latest

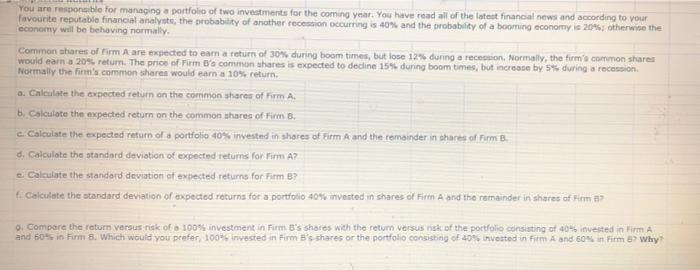

You are responsible for managing a portfolio of two investments for the coming year. You have read all of the latest financial news and according to your favourite reputable financial analyse, the probability of another recession occurring is 40% and the probability of a booming economy is 20%; otherwise the economy will be behaving normally Common shares of firm A are expected to cam a return of 30% during boom times, but lose 12% during a recon. Normally, the firm's common shares would earn a 20% return. The price of Fim b's common shares is expected to decline 15% during boom times, but increase by 5% during a recession Normally the firm's common shares would eam a 10% return a. Calculate the expected return on the common shares of Firm A. b. Calculate the expected return on the common shares of Firm B. c. Calculate the expected return of a portfolio 40% invested in shares of Firm A and the remainder in shares of Form B. d. Calculate the standard deviation of expected returns for Fim A? e Calculate the standard deviation of expected returns for Firm B? Calculate the standard deviation of expected returns for a portfolio 40% invested in shares of Firm A and the remainder in shares of Firm #2 Compare the return versus risk of a 100% investment in Firm's shares with the return versus nisk of the portfolio consisting of 40 invested in Firma and 50% in Firm 8. Which would you prefer, 100invested in Firm's shares or the portfolio consisting of 40% invested in Firm A and 60% in firm > Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts