Question: Step by step solutions please guy's.. not those summary solutions you give please A) BAKALI PLC is funded by as follows: Balancesheet ( begin{array}{lc}text {

Step by step solutions please guy's.. not those summary solutions you give please

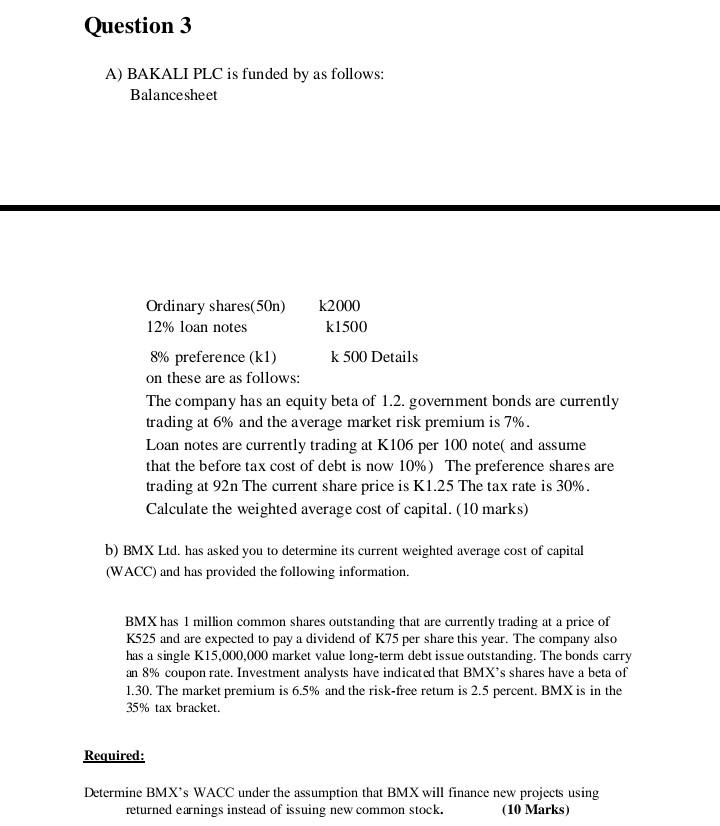

A) BAKALI PLC is funded by as follows: Balancesheet \\( \\begin{array}{lc}\\text { Ordinary shares }(50 \\mathrm{n}) & \\text { k2000 } \\\\ 12 \\% \\text { loan notes } & \\text { k1500 } \\\\ 8 \\% \\text { preference }(\\mathrm{k} 1) & \\mathrm{k} 500 \\text { Details }\\end{array} \\) on these are as follows: The company has an equity beta of 1.2 . government bonds are currently trading at \6 and the average market risk premium is \7. Loan notes are currently trading at K106 per 100 note( and assume that the before tax cost of debt is now \10 ) The preference shares are trading at \\( 92 \\mathrm{n} \\) The current share price is K1.25 The tax rate is \30. Calculate the weighted average cost of capital. (10 marks) b) BMX Ltd. has asked you to determine its current weighted average cost of capital (WACC) and has provided the following information. BMX has 1 million common shares outstanding that are currently trading at a price of \\( \\mathrm{K} 525 \\) and are expected to pay a dividend of \\( \\mathrm{K} 75 \\) per share this year. The company also has a single K15,000,000 market value long-term debt issue outstanding. The bonds carry an \8 coupon rate. Investment analysts have indicated that BMX's shares have a beta of 1.30. The market premium is \6.5 and the risk-free retum is 2.5 percent. BMX is in the \35 tax bracket. Required: Determine BMX's WACC under the assumption that BMX will finance new projects using returned earnings instead of issuing new common stock. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts