Question: Steps for Which of the following causes a temporary difference between taxable and pretax accounting income? The dividends received deduction. Investment expenses incurred to generate

Steps for

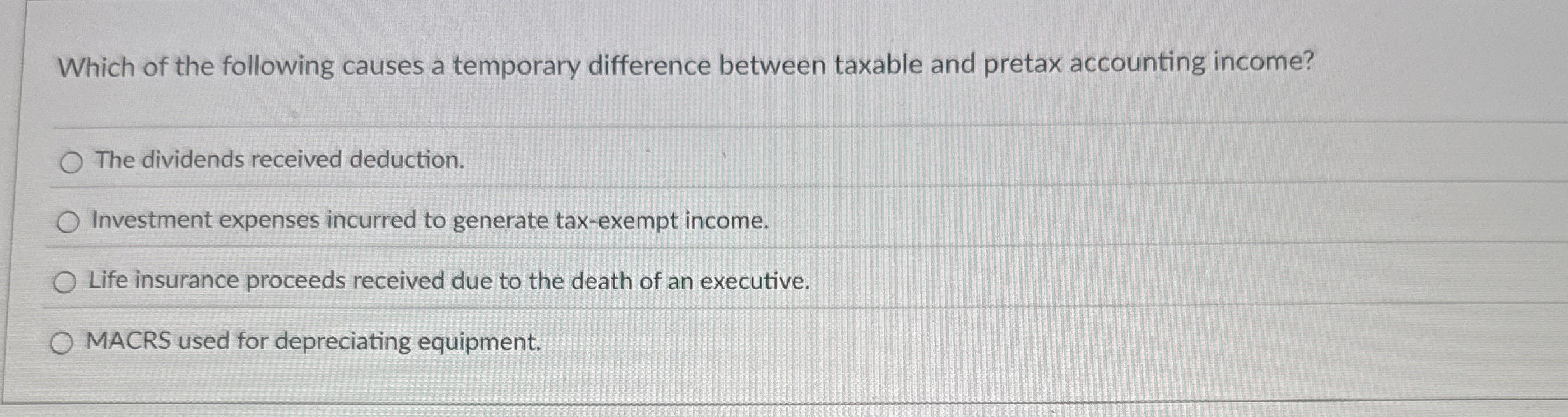

Which of the following causes a temporary difference between taxable and pretax accounting income?

The dividends received deduction.

Investment expenses incurred to generate taxexempt income.

Life insurance proceeds received due to the death of an executive.

MACRS used for depreciating equipment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock