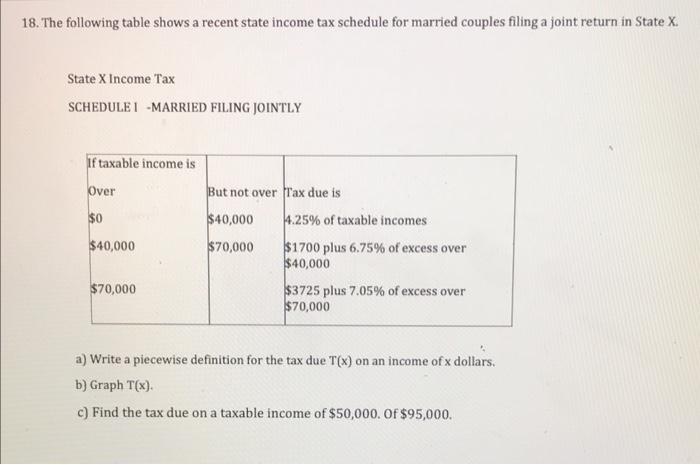

Question: Steps please... 18. The following table shows a recent state income tax schedule for married couples filing a joint return in State X. State X

18. The following table shows a recent state income tax schedule for married couples filing a joint return in State X. State X Income Tax SCHEDULET MARRIED FILING JOINTLY if taxable income is Over $0 $40,000 But not over frax due is $40,000 14.25% of taxable incomes $70,000 $1700 plus 6.75% of excess over $40,000 $3725 plus 7.05% of excess over $70,000 $70,000 a) Write a piecewise definition for the tax due T(x) on an income of dollars. b) Graph T(X) c) Find the tax due on a taxable income of $50,000. OF $95,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts