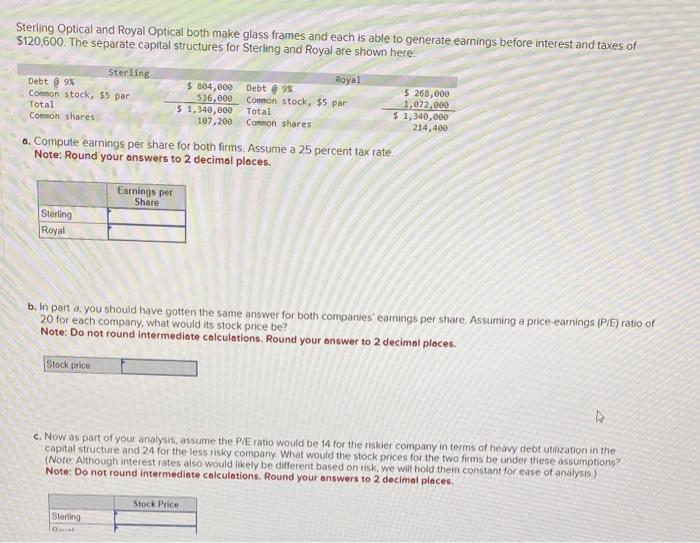

Question: Sterling Optical and Royal Optical both make glass frames and each is able to generate earnings before interest and taxes of $120,600. The separate capital

Sterling Optical and Royal Optical both make glass frames and each is able to generate earnings before interest and taxes of $120,600. The separate capital structures for Sterling and Royal are shown here; a. Compute earnings per share for both firms. Assume a 25 percent tax rate. Note: Round your answers to 2 decimol pleces. b. In part a, you should have gotten the same answer for both companies' eamings per share. Assuming a price-earnings (P/E) ratio of 20 for each company, what would its stock price be? Note: Do not round intermediate calculations. Round your answer to 2 decimal ploces. c. Now as part of your analysis, assume the P.E ratio would be 14 for the riskier company in terms of heavy debt utiization in the capital structure and 24 for the less risky company. What would the stock pices for the two firms be under these assumptions? (Note Although interest rates also would likely be different based on risk, we will hold them constant for ease of analysis.) Note: Do not round intermediate calculations. Round your answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts