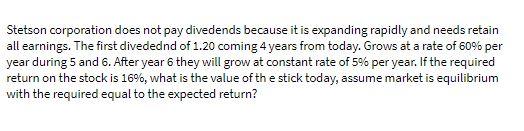

Question: Stetson corporation does not pay divedends because it is expanding rapidly and needs retain all earnings. The first divedednd of 1.20 coming 4 years from

Stetson corporation does not pay divedends because it is expanding rapidly and needs retain all earnings. The first divedednd of 1.20 coming 4 years from today. Grows at a rate of 60% per year during 5 and 6. After year 6 they will grow at constant rate of 5% per year. If the required return on the stock is 16%, what is the value of the stick today, assume market is equilibrium with the required equal to the expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts