Question: Steve is planning to start trading in commodities. He has been reading about the use of futures contracts on commodities. Which of the following is

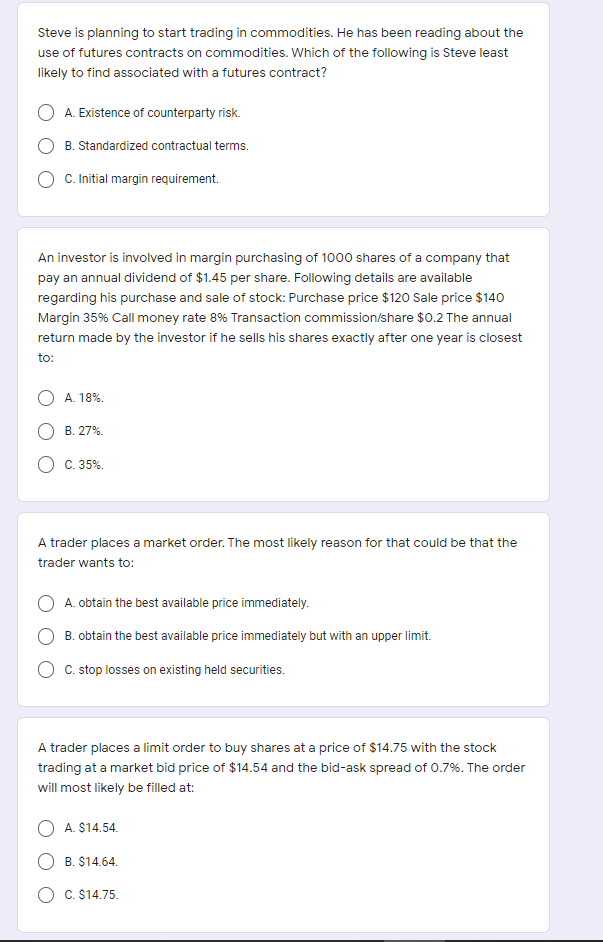

Steve is planning to start trading in commodities. He has been reading about the use of futures contracts on commodities. Which of the following is Steve least likely to find associated with a futures contract? A. Existence of counterparty risk. B. Standardized contractual terms. O C. Initial margin requirement. An investor is involved in margin purchasing of 1000 shares of a company that pay an annual dividend of $1.45 per share. Following details are available regarding his purchase and sale of stock: Purchase price $120 Sale price $140 Margin 35% Call money rate 8% Transaction commission/share $0.2 The annual return made by the investor if he sells his shares exactly after one year is closest to: A. 18% B. 27% C. 35% A trader places a market order. The most likely reason for that could be that the trader wants to: A. obtain the best available price immediately. B. obtain the best available price immediately but with an upper limit. O C. stop losses on existing held securities. A trader places a limit order to buy shares at a price of $14.75 with the stock trading at a market bid price of $14.54 and the bid-ask spread of 0.7%. The order will most likely be filled at: O A. $14.54 B. $14.64 O C. $14.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts