Question: Steve N. Ross has been saving some extra money, which he would like to use for investing. He believes that the APT model is appropriate

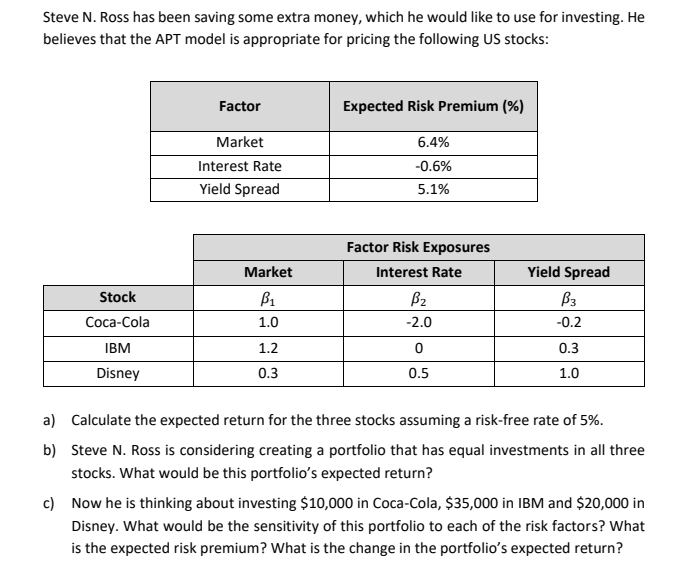

Steve N. Ross has been saving some extra money, which he would like to use for investing. He believes that the APT model is appropriate for pricing the following US stocks: Factor Expected Risk Premium (%) 6.4% Market Interest Rate Yield Spread -0.6% 5.1% Market Factor Risk Exposures Interest Rate B2 -2.0 Bi 1.0 Yield Spread B3 -0.2 Stock Coca-Cola IBM Disney 1.2 0 0.3 1.0 0.3 0.5 a) Calculate the expected return for the three stocks assuming a risk-free rate of 5%. b) Steve N. Ross is considering creating a portfolio that has equal investments in all three stocks. What would be this portfolio's expected return? c) Now he is thinking about investing $10,000 in Coca-Cola, $35,000 in IBM and $20,000 in Disney. What would be the sensitivity of this portfolio to each of the risk factors? What is the expected risk premium? What is the change in the portfolio's expected return? Steve N. Ross has been saving some extra money, which he would like to use for investing. He believes that the APT model is appropriate for pricing the following US stocks: Factor Expected Risk Premium (%) 6.4% Market Interest Rate Yield Spread -0.6% 5.1% Market Factor Risk Exposures Interest Rate B2 -2.0 Bi 1.0 Yield Spread B3 -0.2 Stock Coca-Cola IBM Disney 1.2 0 0.3 1.0 0.3 0.5 a) Calculate the expected return for the three stocks assuming a risk-free rate of 5%. b) Steve N. Ross is considering creating a portfolio that has equal investments in all three stocks. What would be this portfolio's expected return? c) Now he is thinking about investing $10,000 in Coca-Cola, $35,000 in IBM and $20,000 in Disney. What would be the sensitivity of this portfolio to each of the risk factors? What is the expected risk premium? What is the change in the portfolio's expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts