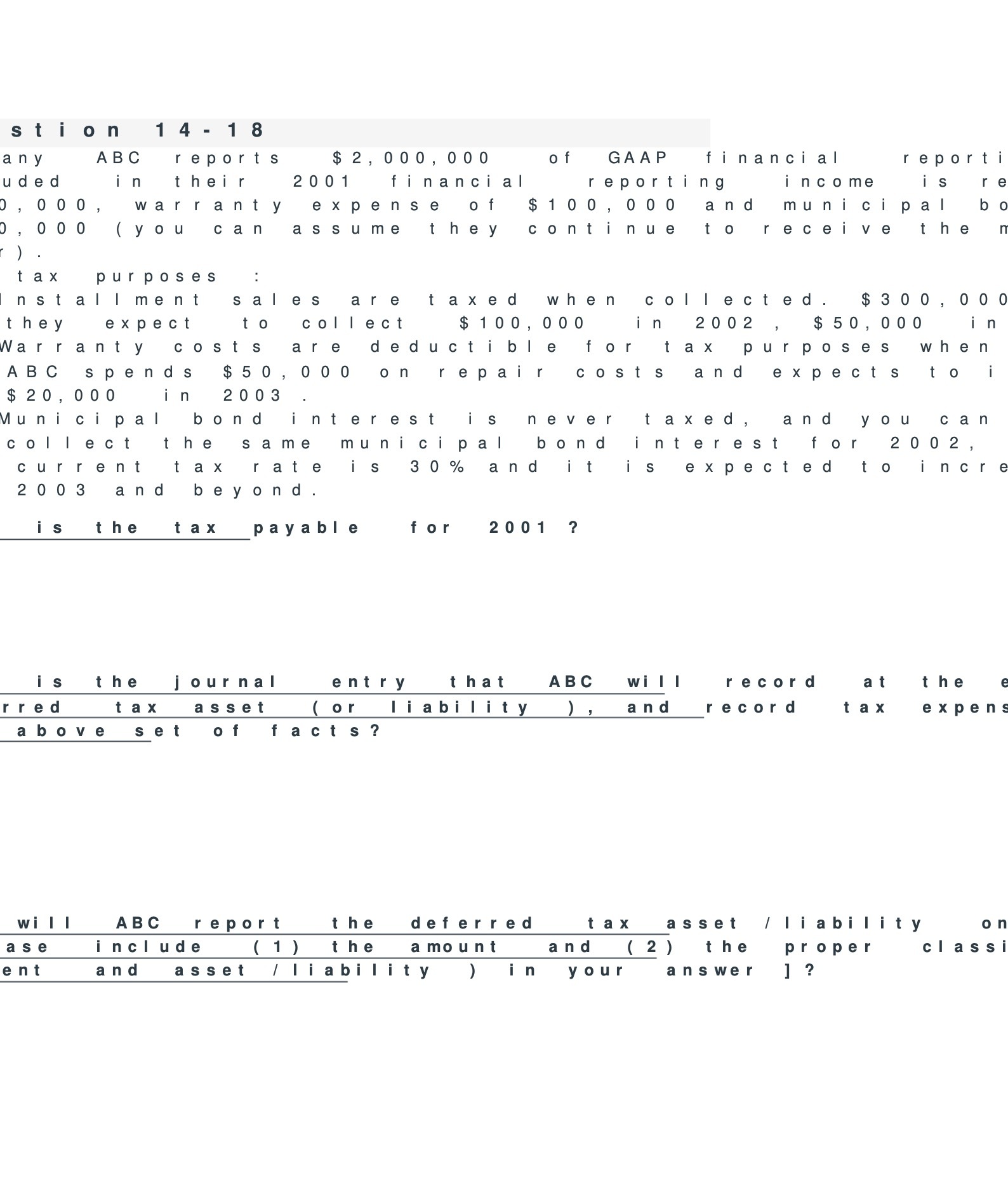

Question: stion 14 - 18 any ABC reports $ 2, 000, 000 of GAAP financial reporti uded in their 2001 financial reporting income S 0 0

stion 14 - 18 any ABC reports $ 2, 000, 000 of GAAP financial reporti uded in their 2001 financial reporting income S 0 0 0 , warranty expense of $10 0 , 00 0 and municipal b 0 0 0 (you can assume they continue to receive the tax purposes nsta I ment sales are taxed when collecte $ 30 0 , 0 0 they expect to collect $ 10 0 , 000 In 2002 $ 50 , 000 in Warranty costs ar deduct ible or tax purposes when ABC spends $50 , 000 on repair costs and expect S t $ 20 , 000 In 2003 Municipal bond interest IS never taxed , and you can collect the same municipal bond interest for 20 02, current tax rate is 3 0 % and t S expected to incr 2003 and beyond is the tax payable for 2001 ? is the journal entry that ABC will record at the rred tax asset (or liability and record tax expen above set of facts ? will ABC report the deferred tax asset / liability 0 ase include (1 ) the a mount and ( 2 ) the proper class ent and asset / liability in your answer 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts