Question: stion Chapter 13 Discussion Question A Please post answe.ne following questions. Due on Feb 26 at This discussion is worth 5 poirits total HOT 1

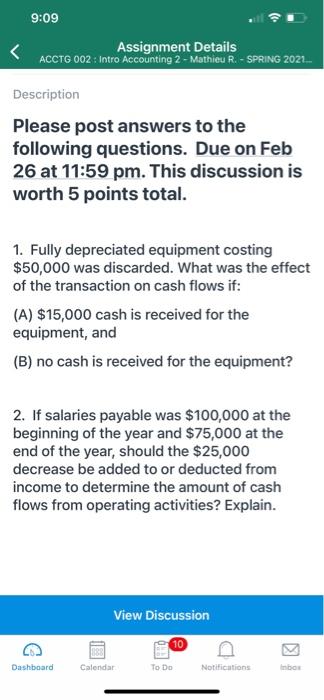

stion Chapter 13 Discussion Question A Please post answe.ne following questions. Due on Feb 26 at This discussion is worth 5 poirits total HOT 1 Flly depreciated event costing $50,000 was discardea What was the effect of the transaction on cash flows if: (A) 51000 cash is received for the equipment and (Bineis feceived for the equipment? es payable was $ 100 000 at the beginning of the me end of the year should the 25,000 9:09 Assignment Details ACCTG 002: Intro Accounting 2 - Mathieu R. - SPRING 202... Description Please post answers to the following questions. Due on Feb 26 at 11:59 pm. This discussion is worth 5 points total. 1. Fully depreciated equipment costing $50,000 was discarded. What was the effect of the transaction on cash flows if: (A) $15,000 cash is received for the equipment, and (B) no cash is received for the equipment? 2. If salaries payable was $100,000 at the beginning of the year and $75,000 at the end of the year, should the $25,000 decrease be added to or deducted from income to determine the amount of cash flows from operating activities? Explain. View Discussion 10 G . Dashboard Calendar To Do Notifications Inbox

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts