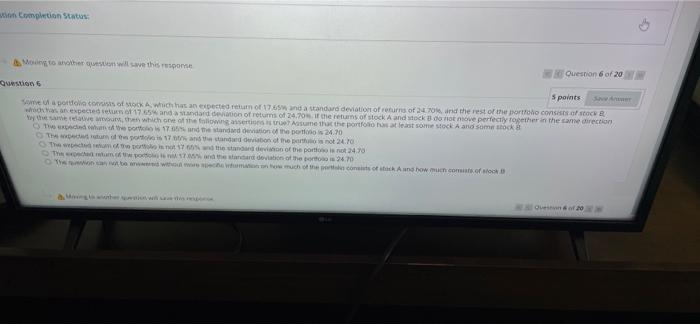

Question: stion Completion Status: Moving to another question will save this response Question 6 Question 6 of 20 5 points: Save Answer Some of a portfolia

stion Completion Status: Moving to another question will save this response Question 6 Question 6 of 20 5 points: Save Answer Some of a portfolia consists of stock A, which has an expected return of 17.65w and a standard deviation of returns of 24 70%, and the rest of the portfolio consists of stock B which has an expected return of 17.65% and a standard deviation of returns of 24,70%. If the returns of stock A and stock 8 do not move perfectly together in the same direction by the same relative amount, then which one of the following assertions is true? Assume that the portfolio has at least some stock A and some stock 8 The expected return of the portfolio is 17.35% and the standard deviation of the portfolio is 24.70 The expected return of the portoo is 17.00 and the standard deviation of the parthulo is not 24.70 The expected return of the portfolio is not 17 60% and the standard deviation of the portfoo is not 24.70 17.05% and the standard deviation of the portoo is 24.70 The expected return of the porticots The restion can not be answered without more specie information on how much of the portales consists of stock A and how much comiats of stock Queen of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts