Question: STOCK 1 HAS A BETA OF 0.59 AND RETURN ON STOCK OF 1.53%. STOCK 2 HAS BETA OF 1.11 AND RETURN ON STOCK OF 1.44%.

STOCK 1 HAS A BETA OF 0.59 AND RETURN ON STOCK OF 1.53%. STOCK 2 HAS BETA OF 1.11 AND RETURN ON STOCK OF 1.44%. STOCK 3 HAS A BETA OF 1.23 AND RETURN ON STOCK OF 3.39%

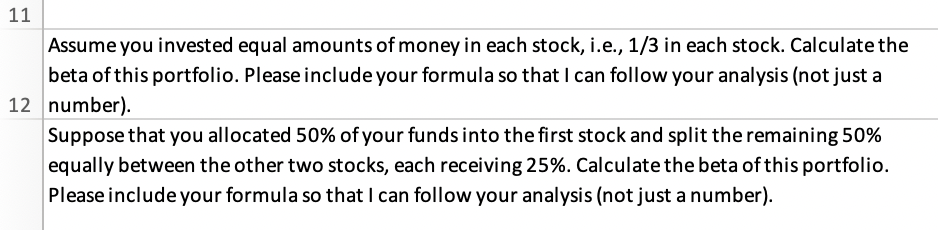

Assume you invested equal amounts of money in each stock, i.e., 1/3 in each stock. Calculate the beta of this portfolio. Please include your formula so that I can follow your analysis (not just a 2 number). Suppose that you allocated 50% of your funds into the first stock and split the remaining 50% equally between the other two stocks, each receiving 25%. Calculate the beta of this portfolio. Please include your formula so that I can follow your analysis (not just a number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts