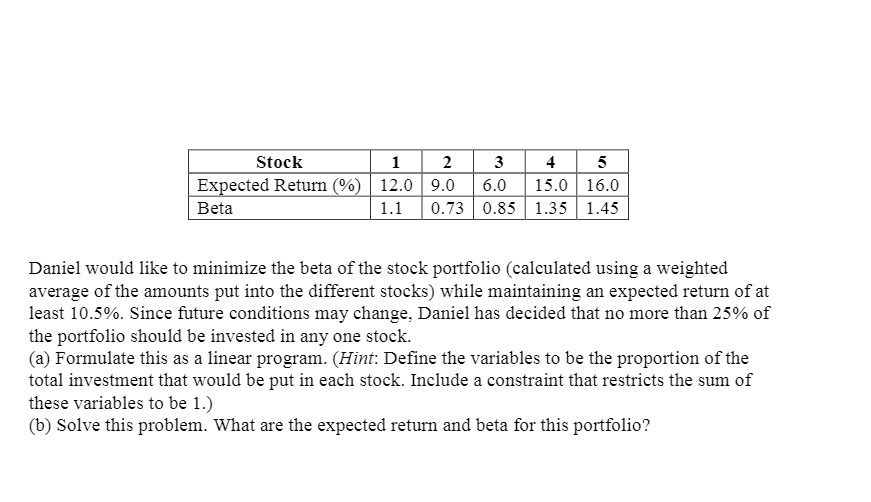

Question: Stock 2 3 4 5 Expected Return (%) 12.0 9.0 6.0 15.0 16.0 Beta 1.1 0.73 0.85 1.35 1.45 Daniel would like to minimize the

Stock 2 3 4 5 Expected Return (%) 12.0 9.0 6.0 15.0 16.0 Beta 1.1 0.73 0.85 1.35 1.45 Daniel would like to minimize the beta of the stock portfolio (calculated using a weighted average of the amounts put into the different stocks) while maintaining an expected return of at least 10.5%. Since future conditions may change, Daniel has decided that no more than 25% of the portfolio should be invested in any one stock. (a) Formulate this as a linear program. (Hint: Define the variables to be the proportion of the total investment that would be put in each stock. Include a constraint that restricts the sum of these variables to be 1.) (b) Solve this problem. What are the expected return and beta for this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts