Question: Stock A ' s beta is 1 . 7 and Stock B ' s beta is 0 . 7 . Which of the following statements

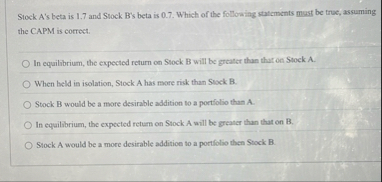

Stock As beta is and Stock Bs beta is Which of the following statements must be true, assuming the CAPM is correct.

In equilibrium, the expected return on Stock B will be greater than that on Stock A

When hast in isolation, Stock A has more risk than Suck B

Stock B would be a more desirable addition to a portiolio than A

In equitibrium, the expected return on Stock A will be greater than that on B

Stock A would be a more desirable addition to a portfolio then Stock B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock