Question: stock and 17. Which chart type is more commonly used for displaying relative strength between the market a. a line chart b. a bar chart

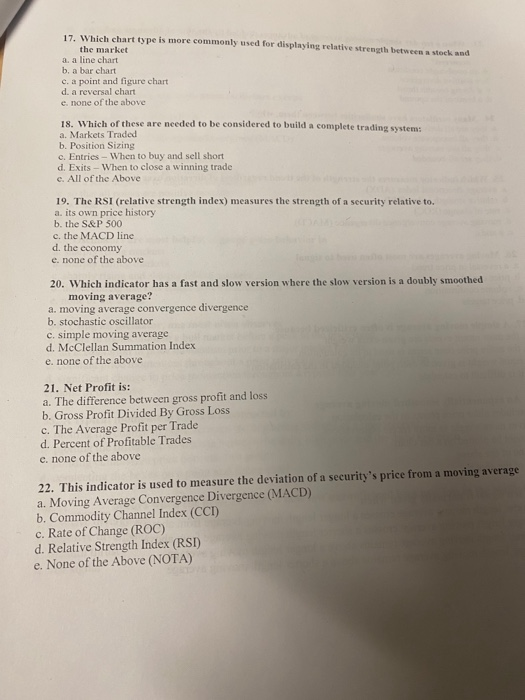

stock and 17. Which chart type is more commonly used for displaying relative strength between the market a. a line chart b. a bar chart c. a point and figure chart d. a reversal chart e none of the above 18. Which of these are needed to be considered to build a complete trading system: a. Markets Traded b. Position Sizing c. Entries - When to buy and sell short d. Exits - When to close a winning trade c. All of the Above 19. The RSI (relative strength index) measures the strength of a security relative to. a. its own price history b. the S&P 500 c. the MACD line d. the economy e. none of the above 20. Which indicator has a fast and slow version where the slow version is a doubly smoothed moving average? a. moving average convergence divergence b. stochastic oscillator c. simple moving average d. McClellan Summation Index e. none of the above 21. Net Profit is: a. The difference between gross profit and loss b. Gross Profit Divided By Gross Loss c. The Average Profit per Trade d. Percent of Profitable Trades c. none of the above 22. This indicator is used to measure the deviation of a security's price from a moving average a. Moving Average Convergence Divergence (MACD) b. Commodity Channel Index (CCI) c. Rate of Change (ROC) d. Relative Strength Index (RSI) e. None of the Above (NOTA)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts