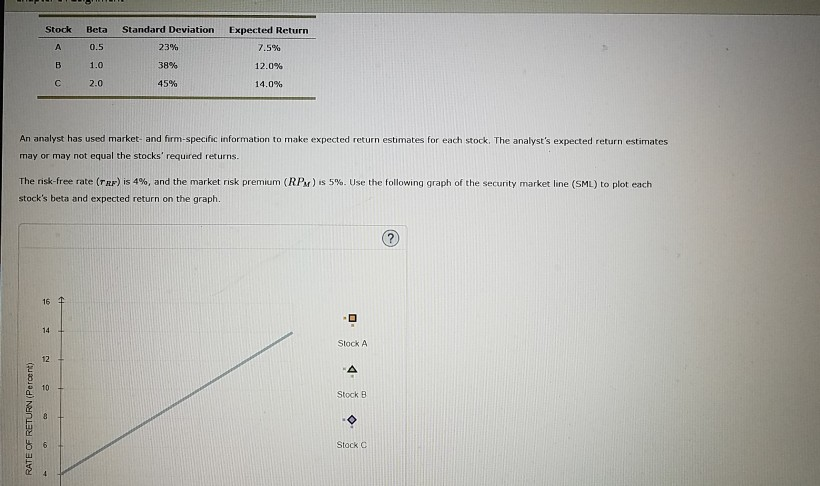

Question: Stock Beta 0.5 Expected Return 7.5% Standard Deviation 23% 38% 45% 1.0 12.0% 14.0% 2.0 An analyst has used market and form-specific information to make

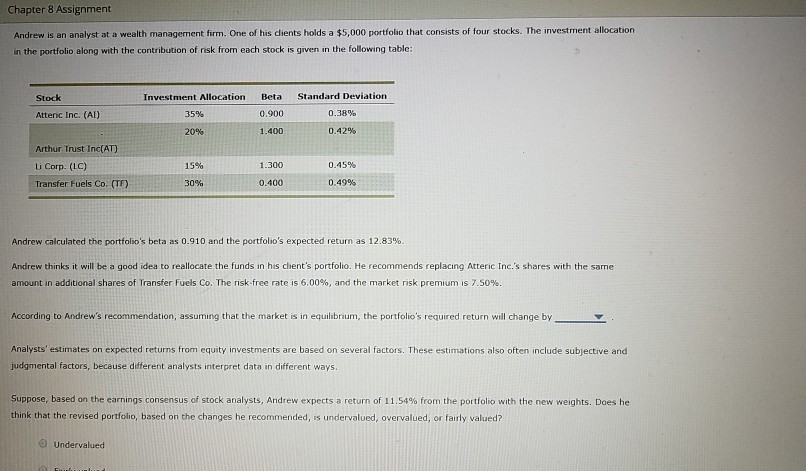

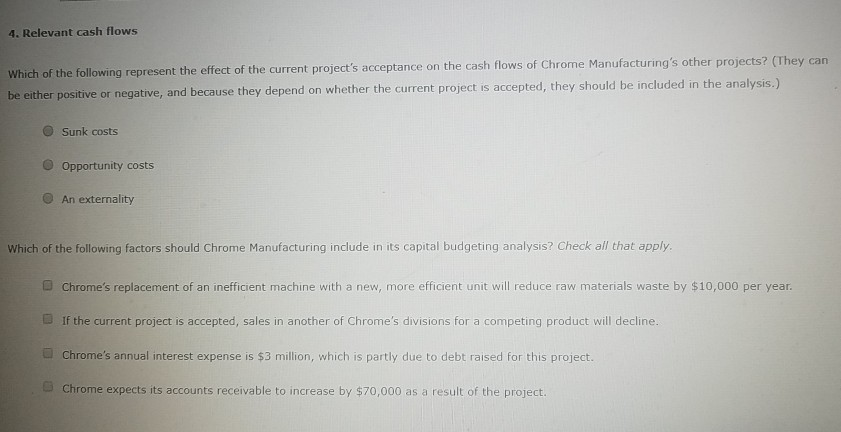

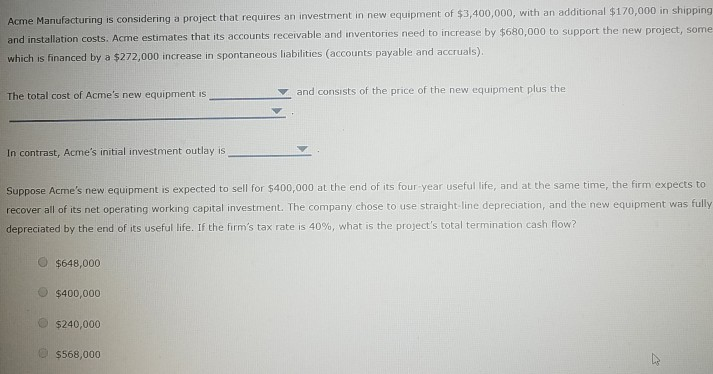

Stock Beta 0.5 Expected Return 7.5% Standard Deviation 23% 38% 45% 1.0 12.0% 14.0% 2.0 An analyst has used market and form-specific information to make expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. The nisk-free rate (TRF) is 4%, and the market risk premium (RPM) is 5%. Use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. Stock A Stock B RATE OF RETURN(Percent) Stock Chapter 8 Assignment Andrew is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation 35% Attenic Inc. (AI) Beta 0.900 1.400 Standard Deviation 0.38% 0.42% 20% Arthur Trust Inc(AT) Li Corp. (LC) Transfer Fuels Co. (TE) 15% 30%. 1.300 0.400 0.45% 0.49% Andrew calculated the portfolio's beta as 0.910 and the portfolio's expected return as 12.83%. Andrew thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends replacing Atteric Inc.'s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 6.00%, and the market risk premium is 7.50%. According to Andrew's recommendation, assuming that the market is in equilibrium, the portfolio's required return will change by Analysts' estimates on expected returns from equity investments are based on several factors. These estimations also often include subjective and judgmental factors, because different analysts interpret data in different ways. Suppose, based on the earnings consensus of stock analysts, Andrew expects a return of 11.54% from the portfolio with the new weights. Does he think that the revised portfolio, based on the changes he recommended, is undervalued, overvalued, or fairly valued? Undervalued 4. Relevant cash flows Which of the following represent the effect of the current project's acceptance on the cash flows of Chrome Manufacturing's other projects? (They can be either positive or negative, and because they depend on whether the current project is accepted, they should be included in the analysis.) O Sunk costs Opportunity costs An externality Which of the following factors should Chrome Manufacturing include in its capital budgeting analysis? Check all that apply. Chrome's replacement of an inefficient machine with a new, more efficient unit will reduce raw materials waste by $10,000 per year. If the current project is accepted, sales in another of Chrome's divisions for a competing product will decline. Chrome's annual interest expense is $3 million, which is partly due to debt raised for this project. Chrome expects its accounts receivable to increase by $70,000 as a result of the project. Acme Manufacturing is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in shipping and installation costs. Acme estimates that its accounts receivable and inventories need to increase by $680,000 to support the new project, some which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals), The total cost of Acme's new equipment is and consists of the price of the new equipment plus the In contrast, Acme's initial investment outlay is Suppose Acme's new equipment is expected to sell for $400,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working capital investment. The company chose to use straight line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? $648,000 $400,000 $240,000 $568,000 Stock Beta 0.5 Expected Return 7.5% Standard Deviation 23% 38% 45% 1.0 12.0% 14.0% 2.0 An analyst has used market and form-specific information to make expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. The nisk-free rate (TRF) is 4%, and the market risk premium (RPM) is 5%. Use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. Stock A Stock B RATE OF RETURN(Percent) Stock Chapter 8 Assignment Andrew is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation 35% Attenic Inc. (AI) Beta 0.900 1.400 Standard Deviation 0.38% 0.42% 20% Arthur Trust Inc(AT) Li Corp. (LC) Transfer Fuels Co. (TE) 15% 30%. 1.300 0.400 0.45% 0.49% Andrew calculated the portfolio's beta as 0.910 and the portfolio's expected return as 12.83%. Andrew thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends replacing Atteric Inc.'s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 6.00%, and the market risk premium is 7.50%. According to Andrew's recommendation, assuming that the market is in equilibrium, the portfolio's required return will change by Analysts' estimates on expected returns from equity investments are based on several factors. These estimations also often include subjective and judgmental factors, because different analysts interpret data in different ways. Suppose, based on the earnings consensus of stock analysts, Andrew expects a return of 11.54% from the portfolio with the new weights. Does he think that the revised portfolio, based on the changes he recommended, is undervalued, overvalued, or fairly valued? Undervalued 4. Relevant cash flows Which of the following represent the effect of the current project's acceptance on the cash flows of Chrome Manufacturing's other projects? (They can be either positive or negative, and because they depend on whether the current project is accepted, they should be included in the analysis.) O Sunk costs Opportunity costs An externality Which of the following factors should Chrome Manufacturing include in its capital budgeting analysis? Check all that apply. Chrome's replacement of an inefficient machine with a new, more efficient unit will reduce raw materials waste by $10,000 per year. If the current project is accepted, sales in another of Chrome's divisions for a competing product will decline. Chrome's annual interest expense is $3 million, which is partly due to debt raised for this project. Chrome expects its accounts receivable to increase by $70,000 as a result of the project. Acme Manufacturing is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in shipping and installation costs. Acme estimates that its accounts receivable and inventories need to increase by $680,000 to support the new project, some which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals), The total cost of Acme's new equipment is and consists of the price of the new equipment plus the In contrast, Acme's initial investment outlay is Suppose Acme's new equipment is expected to sell for $400,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working capital investment. The company chose to use straight line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow? $648,000 $400,000 $240,000 $568,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts