Question: Stock Expected Return 8% Market Expected Return 5% Stock Return Standard Deviation 35% Market Return Standard Deviation 15% What is Weight in Stock, Weight in

Stock Expected Return 8%

Market Expected Return 5%

Stock Return Standard Deviation 35%

Market Return Standard Deviation 15%

What is Weight in Stock, Weight in Market, and Portfolio Expected Return?

What are Portfolio Variance, Portfolio Standard Deviation, and Portfolio Sharpe Ratio?

Need an explanation of the calculations and answers with formulas or functions in the excel sheet of the above questions.

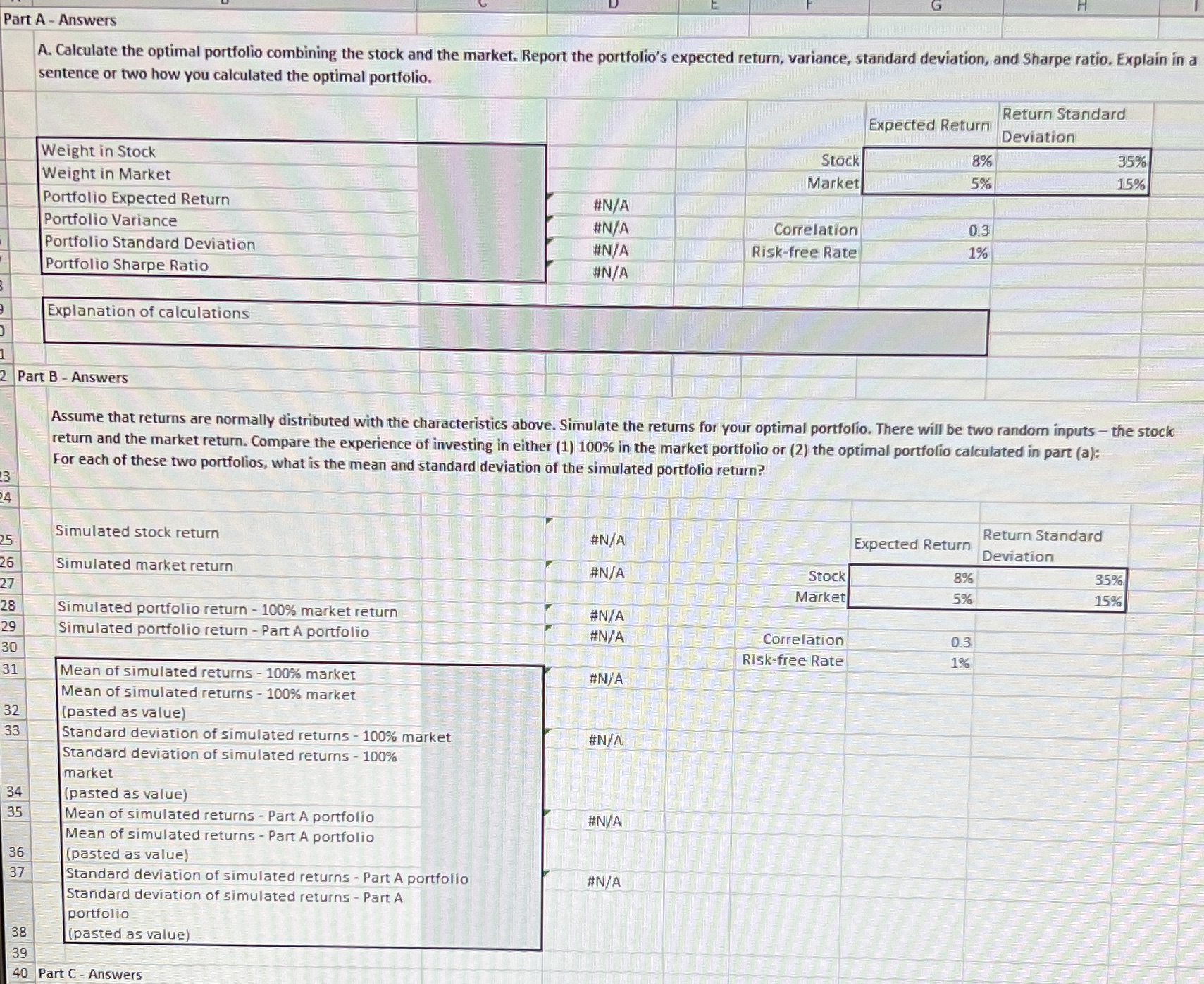

Part A - Answers A. Calculate the optimal portfolio combining the stock and the market. Report the portfolio's expected return, variance, standard deviation, and Sharpe ratio. Explain in a sentence or two how you calculated the optimal portfolio. Return Standard Expected Return Deviation Weight in Stock Stock 8% 35% Weight in Market Market 5% 15% Portfolio Expected Return #N/A Portfolio Variance #N/A Correlation 0.3 Portfolio Standard Deviation #N/A Risk-free Rate 1% Portfolio Sharpe Ratio #N/A Explanation of calculations Part B - Answers Assume that returns are normally distributed with the characteristics above. Simulate the returns for your optimal portfolio. There will be two random inputs - the stock return and the market return. Compare the experience of investing in either (1) 100% in the market portfolio or (2) the optimal portfolio calculated in part (a): For each of these two portfolios, what is the mean and standard deviation of the simulated portfolio return? Return Standard Simulated stock return #N/A Expected Return 25 Deviation 26 Simulated market return #N/A Stock 8% 35% 27 Market 5% 15% 28 Simulated portfolio return - 100% market return #N/A 29 Simulated portfolio return - Part A portfolio #N/A Correlation 0.3 30 Risk-free Rate 1% 31 Mean of simulated returns - 100% market #N/A Mean of simulated returns - 100% market 32 (pasted as value) 33 Standard deviation of simulated returns - 100% market #N/A Standard deviation of simulated returns - 100% market 34 (pasted as value) 35 Mean of simulated returns - Part A portfolio #N/A Mean of simulated returns - Part A portfolio 36 (pasted as value) 37 Standard deviation of simulated returns - Part A portfolio #N/A Standard deviation of simulated returns - Part A portfolio 38 (pasted as value) 39 40 Part C - Answers