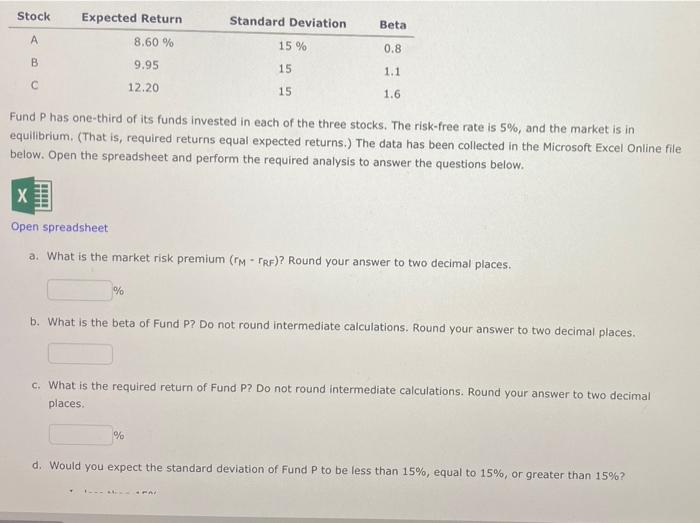

Question: Stock Expected Return Standard Deviation Beta A 8.60 % 15 % 0.8 B 9.95 15 1.1 12.20 15 1.6 Fund P has one-third of its

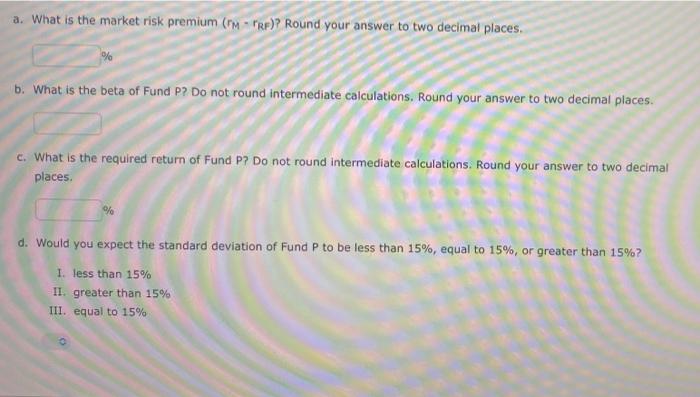

Stock Expected Return Standard Deviation Beta A 8.60 % 15 % 0.8 B 9.95 15 1.1 12.20 15 1.6 Fund P has one-third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium. (That is, required returns equal expected returns.) The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is the market risk premium (M-PRF)? Round your answer to two decimal places. % b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places % d. Would you expect the standard deviation of Fund P to be less than 15%, equal to 15%, or greater than 15%? a. What is the market risk premium (Rp)? Round your answer to two decimal places. b. What is the beta of Fund P? Do not round intermediate calculations. Round your answer to two decimal places. c. What is the required return of Fund P? Do not round intermediate calculations. Round your answer to two decimal places % d. Would you expect the standard deviation of Fund P to be less than 15%, equal to 15%, or greater than 15%? 1. less than 15% II. greater than 15% III. equal to 15% o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts