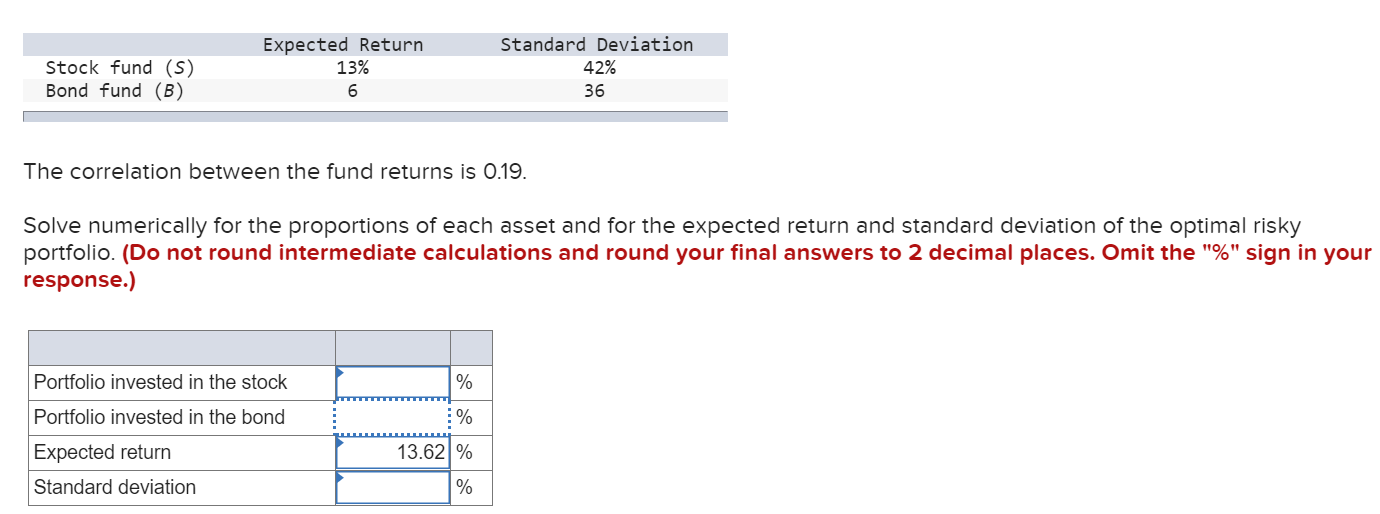

Question: Stock fund (S) Bond fund (B) Expected Return 13% 6 Standard Deviation 42% 36 The correlation between the fund returns is 0.19. Solve numerically for

Stock fund (S) Bond fund (B) Expected Return 13% 6 Standard Deviation 42% 36 The correlation between the fund returns is 0.19. Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. (Do not round intermediate calculations and round your final answers to 2 decimal places. Omit the "%" sign in your response.) % % Portfolio invested in the stock Portfolio invested in the bond Expected return Standard deviation 13.62% %

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock