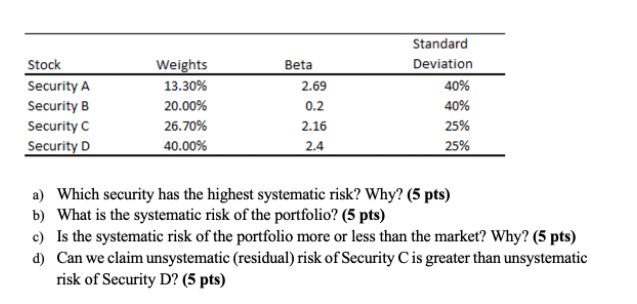

Question: Stock Security A Security B Security C Security D Weights 13.30% 20.00% 26.70% 40.00% Beta 2.69 0.2 2.16 2.4 Standard Deviation 40% 40% 25% 25%

Stock Security A Security B Security C Security D Weights 13.30% 20.00% 26.70% 40.00% Beta 2.69 0.2 2.16 2.4 Standard Deviation 40% 40% 25% 25% a) Which security has the highest systematic risk? Why? (5 pts) b) What is the systematic risk of the portfolio? (5 pts) c) Is the systematic risk of the portfolio more or less than the market? Why? (5 pts) d) Can we claim unsystematic (residual) risk of Security Cis greater than unsystematic risk of Security D? (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts