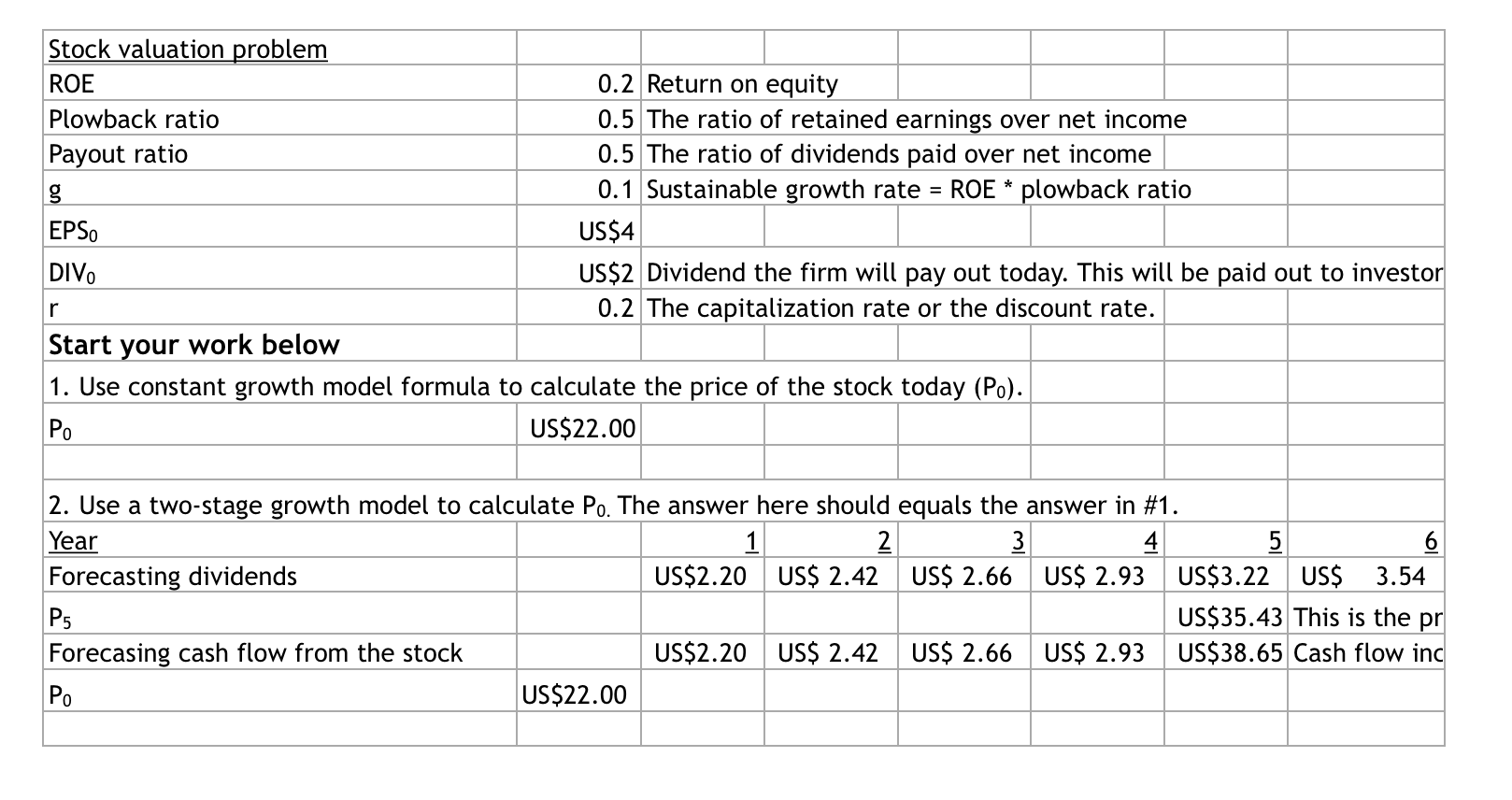

Question: Stock valuation problem ROE 0.2 Return on equity Plowback ratio 0.5 The ratio of retained earnings over net income Payout ratio 0.5 The ratio of

Stock valuation problem ROE 0.2 Return on equity Plowback ratio 0.5 The ratio of retained earnings over net income Payout ratio 0.5 The ratio of dividends paid over net income g 0.1 Sustainable growth rate = ROE * plowback ratio EPSO US$4 DIVO US$2 Dividend the firm will pay out today. This will be paid out to investor 0.2 The capitalization rate or the discount rate. Start your work below 1. Use constant growth model formula to calculate the price of the stock today (Po). US$22.00 r 2. Use a two-stage growth model to calculate Po. The answer here should equals the answer in #1. Year 1 2 3 4 Forecasting dividends US$2.20 US$ 2.42 US$ 2.66 US$ 2.93 US$3.22 US$ 3.54 P5 US$35.43 This is the pr Forecasing cash flow from the stock US$2.20 US$ 2.42 US$ 2.66 US$ 2.93 US$38.65 Cash flow inc Po US$22.00 Stock valuation problem ROE 0.2 Return on equity Plowback ratio 0.5 The ratio of retained earnings over net income Payout ratio 0.5 The ratio of dividends paid over net income g 0.1 Sustainable growth rate = ROE * plowback ratio EPSO US$4 DIVO US$2 Dividend the firm will pay out today. This will be paid out to investor 0.2 The capitalization rate or the discount rate. Start your work below 1. Use constant growth model formula to calculate the price of the stock today (Po). US$22.00 r 2. Use a two-stage growth model to calculate Po. The answer here should equals the answer in #1. Year 1 2 3 4 Forecasting dividends US$2.20 US$ 2.42 US$ 2.66 US$ 2.93 US$3.22 US$ 3.54 P5 US$35.43 This is the pr Forecasing cash flow from the stock US$2.20 US$ 2.42 US$ 2.66 US$ 2.93 US$38.65 Cash flow inc Po US$22.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts