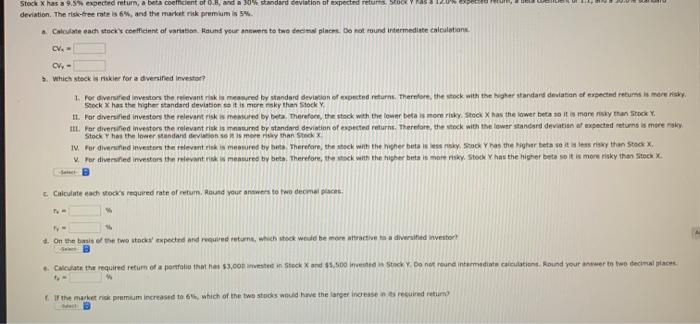

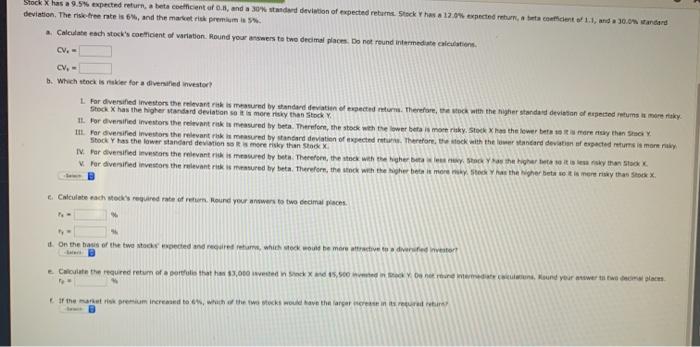

Question: Stock x has a 9,5% expected return, beta coefficient of us, and a 30% standard deviation of expected returns to deviation. The risk-free rate is

Stock x has a 9,5% expected return, beta coefficient of us, and a 30% standard deviation of expected returns to deviation. The risk-free rate is 6%, and the market rik premium 55% Catate each stock cofficient of variation Hound your answer to two decimal places. Do not found intermediate calculation CV. CW- Which stock risker for a diversified Investar? 1. For diverted into the relevant risk measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns is more sky, Stock x has the higher standard deviation so it is more risky than Stock 11. For diversified investors the relevant risk is memured by be. Therefore, the stock with the lower betas more risky Stock X has the lower be it is more risky than Stock II. For diversified investors the relevant risk is metured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more maky Stock y has the lower standard deviation is more than Stock IV. For diversified investors the televant mesured by both Therefore, the stock with the herbata eky Stoly as the greta sewens isay than Stock for diversified investors the meantimeasured by bets, Therefore, the seck with the higher betale more risky. Stock has the higher but so it is more risky than Stock Calculate each required rate of retum, Round your answers to two decimal places d. On the basis of the two stocks expected and required returns, which stock would be more attractive to a diversified Investor Calculate the required return of a portfolio that has $3.00 ed in Stock X and $5,500 in Stock y Do not round Intermediate actions. Round your wwwer to two decimal places If the market rick premium increased to 65, which of the two stocks would have the large incesse nos recurred return Stock X has a 9.5% expected return, abeta coefficient of 0.8, and a 30% standard deviation of expected returns Stock has a 12.0 expected return, conto 1.1, and a 30.04 Wandard deviation. The rise free rate is 6, and the materie premis .. Calculate each stock's coeficient of variation Hound your answers to the decimal places. Do not round intermediate cafestations CV. CV. Which stock is takler for a diversified investor 1. For diversified investors the relevant risk is measured by standard deviation of expected return. Therefore, cock with the higher standard deviation of expected retums is more sky Stock X has the Nigher Mandard deviations is more sky than Stock IL for diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower bets is more risky, Stock Xh the lower berendy then III. For diversified investors the relevant rok is measured by standard deviation of expected returns. Therefore, the stock with the lower andard deviation of expected returns is more Stock Y has the lower standard deviation more sky than stock IV. for versified Investors the relevant risk ismered by hea. Therefore, the stock with the bora Bw the highest skytha Stock For diversified Investors the relevant riski ured by beta Therefore, the stock with the higher be is more than the Niger beta te is mererisythas Stock Calculate each o'sired rate of return. Round your own to two decimal places T- On the basis of the tweede spected and redres, which we would be more attractive to a diferent Calculate the roured return of this that has 13,000 invested 15.500 med en intermediate, Nound your two If the mana premium increased to which the socks would have the larger centre Stock x has a 9,5% expected return, beta coefficient of us, and a 30% standard deviation of expected returns to deviation. The risk-free rate is 6%, and the market rik premium 55% Catate each stock cofficient of variation Hound your answer to two decimal places. Do not found intermediate calculation CV. CW- Which stock risker for a diversified Investar? 1. For diverted into the relevant risk measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns is more sky, Stock x has the higher standard deviation so it is more risky than Stock 11. For diversified investors the relevant risk is memured by be. Therefore, the stock with the lower betas more risky Stock X has the lower be it is more risky than Stock II. For diversified investors the relevant risk is metured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more maky Stock y has the lower standard deviation is more than Stock IV. For diversified investors the televant mesured by both Therefore, the stock with the herbata eky Stoly as the greta sewens isay than Stock for diversified investors the meantimeasured by bets, Therefore, the seck with the higher betale more risky. Stock has the higher but so it is more risky than Stock Calculate each required rate of retum, Round your answers to two decimal places d. On the basis of the two stocks expected and required returns, which stock would be more attractive to a diversified Investor Calculate the required return of a portfolio that has $3.00 ed in Stock X and $5,500 in Stock y Do not round Intermediate actions. Round your wwwer to two decimal places If the market rick premium increased to 65, which of the two stocks would have the large incesse nos recurred return Stock X has a 9.5% expected return, abeta coefficient of 0.8, and a 30% standard deviation of expected returns Stock has a 12.0 expected return, conto 1.1, and a 30.04 Wandard deviation. The rise free rate is 6, and the materie premis .. Calculate each stock's coeficient of variation Hound your answers to the decimal places. Do not round intermediate cafestations CV. CV. Which stock is takler for a diversified investor 1. For diversified investors the relevant risk is measured by standard deviation of expected return. Therefore, cock with the higher standard deviation of expected retums is more sky Stock X has the Nigher Mandard deviations is more sky than Stock IL for diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower bets is more risky, Stock Xh the lower berendy then III. For diversified investors the relevant rok is measured by standard deviation of expected returns. Therefore, the stock with the lower andard deviation of expected returns is more Stock Y has the lower standard deviation more sky than stock IV. for versified Investors the relevant risk ismered by hea. Therefore, the stock with the bora Bw the highest skytha Stock For diversified Investors the relevant riski ured by beta Therefore, the stock with the higher be is more than the Niger beta te is mererisythas Stock Calculate each o'sired rate of return. Round your own to two decimal places T- On the basis of the tweede spected and redres, which we would be more attractive to a diferent Calculate the roured return of this that has 13,000 invested 15.500 med en intermediate, Nound your two If the mana premium increased to which the socks would have the larger centre

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts