Question: Stockholder and manager conflicts Executive compensation packages often tie performance to bonus and incentive awards, supplemental retirement packages, perquisites, and severance pay, in order to

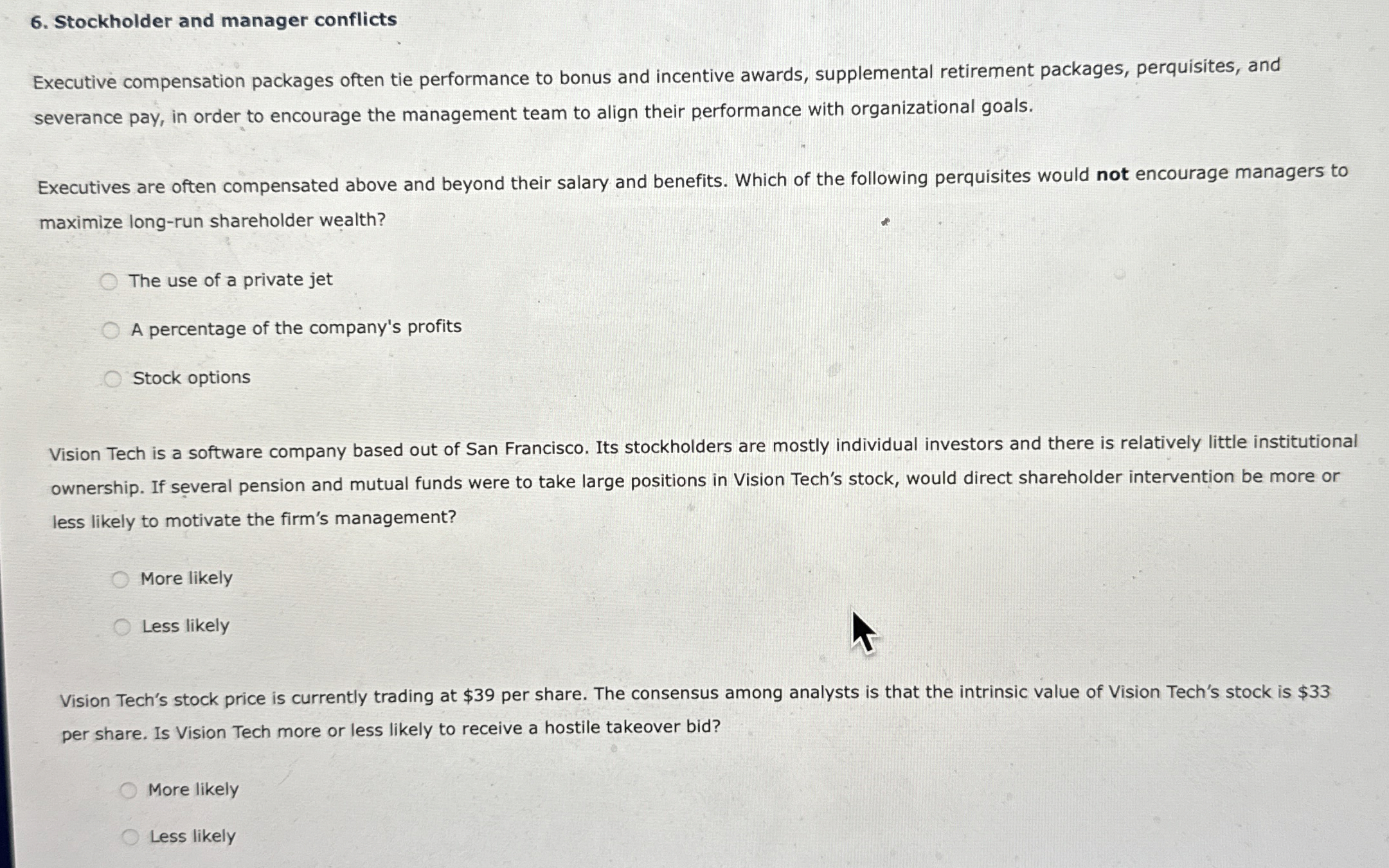

Stockholder and manager conflicts

Executive compensation packages often tie performance to bonus and incentive awards, supplemental retirement packages, perquisites, and severance pay, in order to encourage the management team to align their performance with organizational goals.

Executives are often compensated above and beyond their salary and benefits. Which of the following perquisites would not encourage managers to maximize longrun shareholder wealth?

The use of a private jet

A percentage of the company's profits

Stock options

Vision Tech is a software company based out of San Francisco. Its stockholders are mostly individual investors and there is relatively little institutional ownership. If several pension and mutual funds were to take large positions in Vision Tech's stock, would direct shareholder intervention be more or less likely to motivate the firm's management?

More likely

Less likely

Vision Tech's stock price is currently trading at $ per share. The consensus among analysts is that the intrinsic value of Vision Tech's stock is $ per share. Is Vision Tech more or less likely to receive a hostile takeover bid?

More likely

Less likely

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock