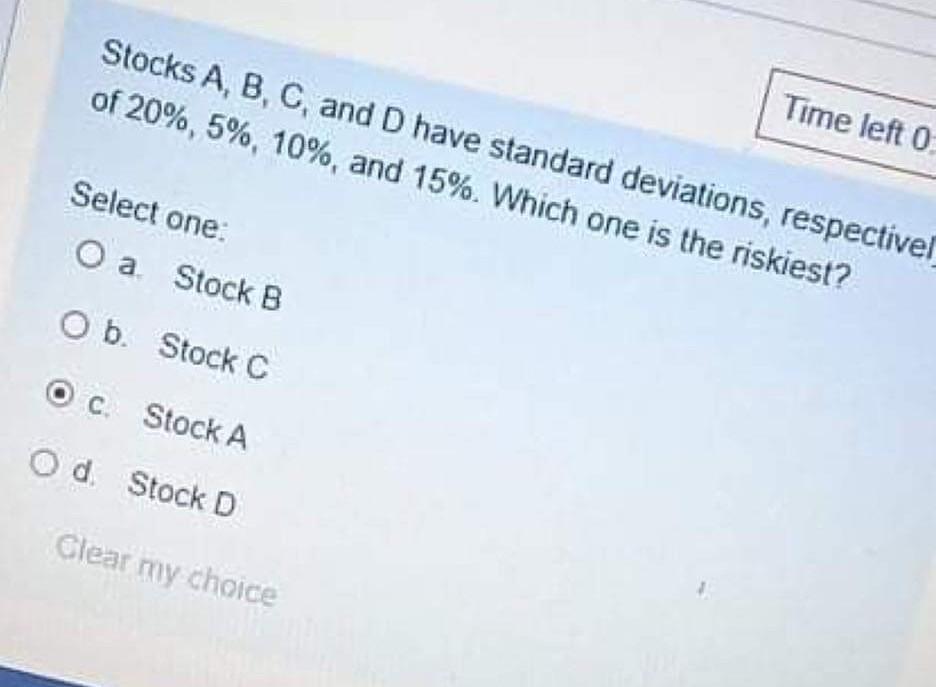

Question: Stocks A, B, C, and D have standard deviations, respectivel of 20%, 5%, 10%, and 15%. Which one is the riskiest? Time left 0 Select

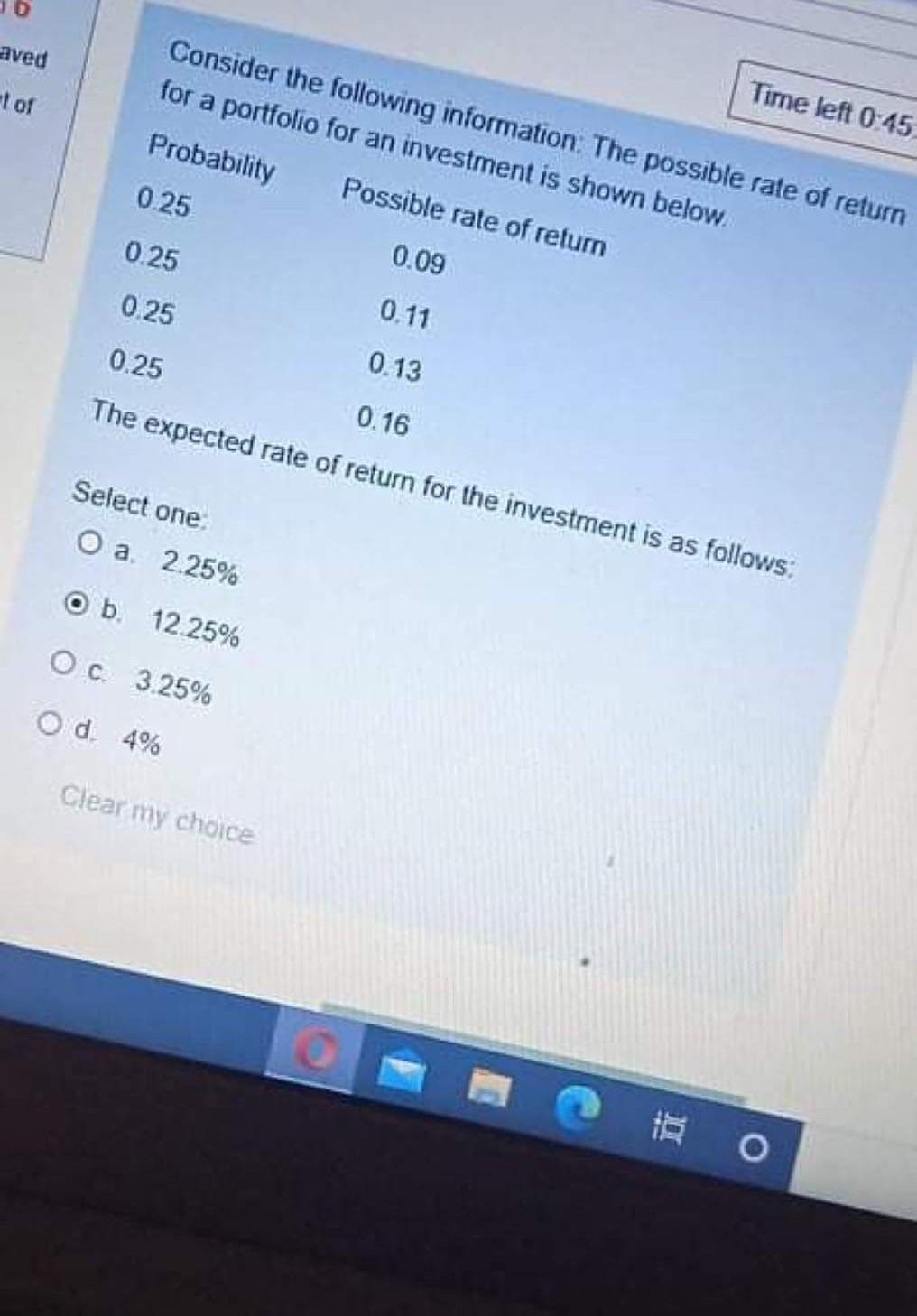

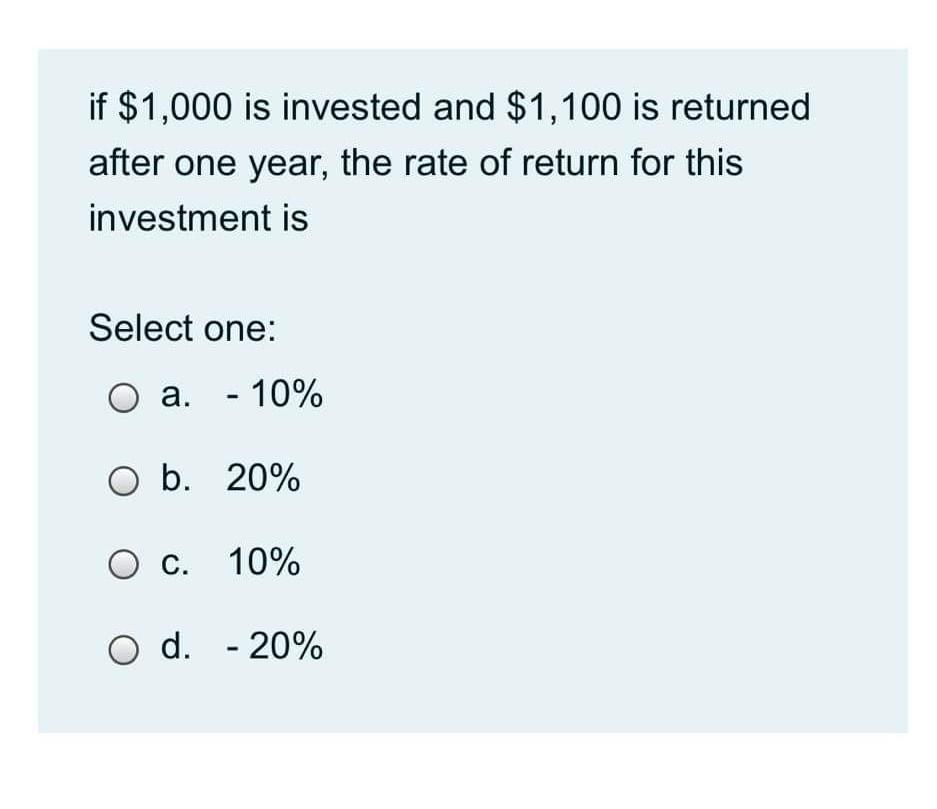

Stocks A, B, C, and D have standard deviations, respectivel of 20%, 5%, 10%, and 15%. Which one is the riskiest? Time left 0 Select one: Oa Stock B b. Stock C OC Stock A Od Stock D Clear my choice aved tor Time left 0-45 Consider the following information The possible rate of return for a portfolio for an investment is shown below. Probability Possible rate of return 0.25 0.09 0.25 0.25 0.11 0.25 0.13 The expected rate of return for the investment is as follows: 0.16 Select one Oa 2.25% Ob 12.25% Oc. 3.25% Od 4% Clear my choice Bo if $1,000 is invested and $1,100 is returned after one year, the rate of return for this investment is Select one: : a. - 10% O b. 20% O C. c. 10% O d. - 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts