Question: Stocks Handout 1 Termial Values.docx Problem 1. You expect a stock to pay the following dividends in the future: 2 $2 3 $4.20 $1 4

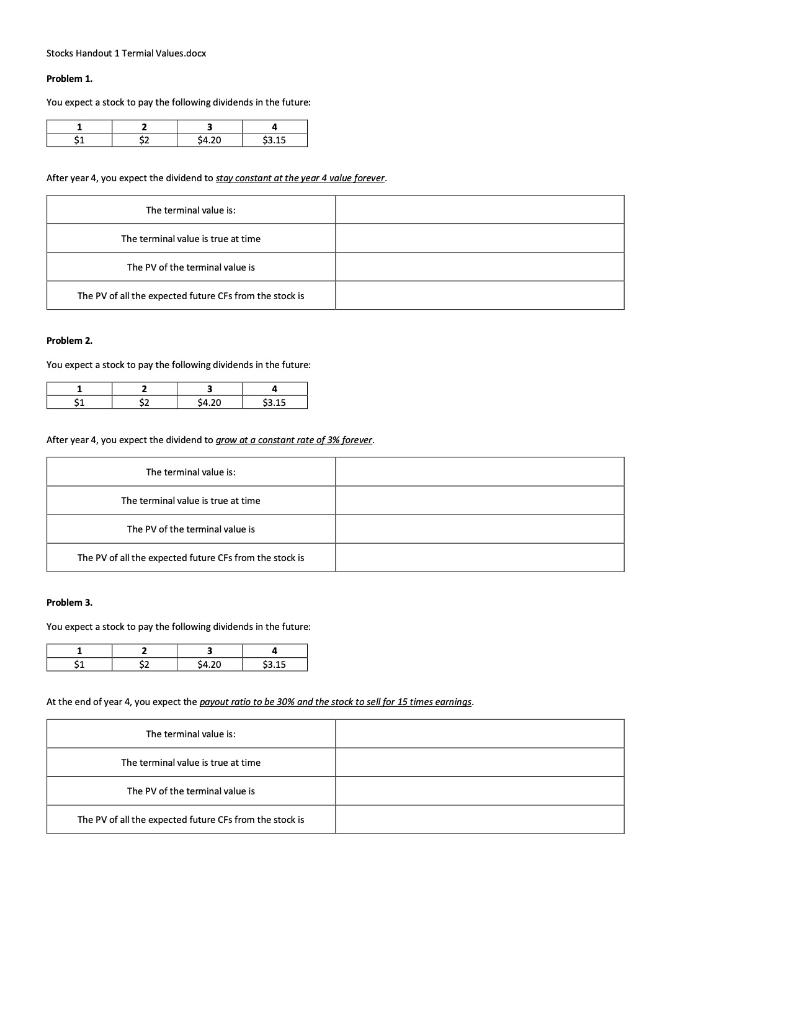

Stocks Handout 1 Termial Values.docx Problem 1. You expect a stock to pay the following dividends in the future: 2 $2 3 $4.20 $1 4 $3.15 After year 4, you expect the dividend to stay constant at the year 4 value forever. The terminal value is: The terminal value is true at time The PV of the terminal value is The PV of all the expected future CFs from the stock is Problem 2. You expect a stock to pay the following dividends in the future: 1 $1 2 $2 3 $4.20 4 $3.15 After year 4, you expect the dividend to grow at a constant rate of 3% forever. The terminal value is: The terminal value is true at time The PV of the terminal value is The PV of all the expected future CFs from the stock is Problem 3. You expect a stock to pay the following dividends in the future: 2 $2 3 $4.20 4 $3.15 S1 At the end of year 4. you expect the payout ratio to be 30% and the stock to sell for 15 times earnings The terminal value is: The terminal value is true at time The PV of the terminal value is The PV of all the expected future CFs from the stock is Stocks Handout 1 Termial Values.docx Problem 1. You expect a stock to pay the following dividends in the future: 2 $2 3 $4.20 $1 4 $3.15 After year 4, you expect the dividend to stay constant at the year 4 value forever. The terminal value is: The terminal value is true at time The PV of the terminal value is The PV of all the expected future CFs from the stock is Problem 2. You expect a stock to pay the following dividends in the future: 1 $1 2 $2 3 $4.20 4 $3.15 After year 4, you expect the dividend to grow at a constant rate of 3% forever. The terminal value is: The terminal value is true at time The PV of the terminal value is The PV of all the expected future CFs from the stock is Problem 3. You expect a stock to pay the following dividends in the future: 2 $2 3 $4.20 4 $3.15 S1 At the end of year 4. you expect the payout ratio to be 30% and the stock to sell for 15 times earnings The terminal value is: The terminal value is true at time The PV of the terminal value is The PV of all the expected future CFs from the stock is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts