Question: Stocks that pay relatively large cash dividends on a regular basis are called: Multiple Choice Small capital stocks. Mid capital stocks. Growth stocks. Large capital

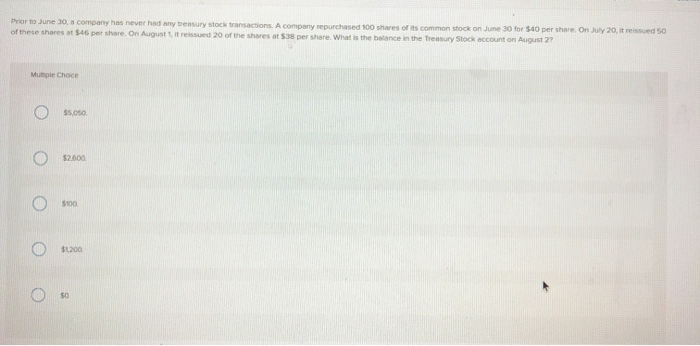

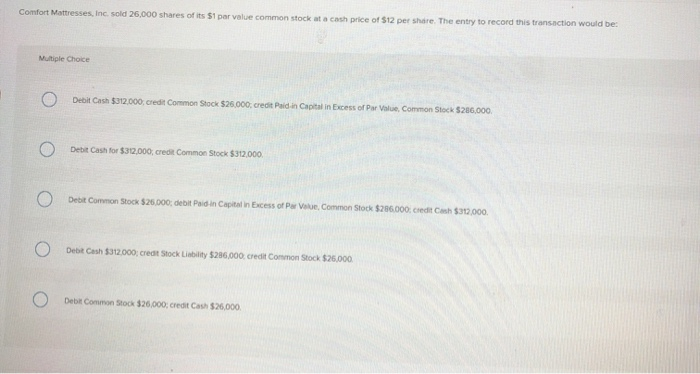

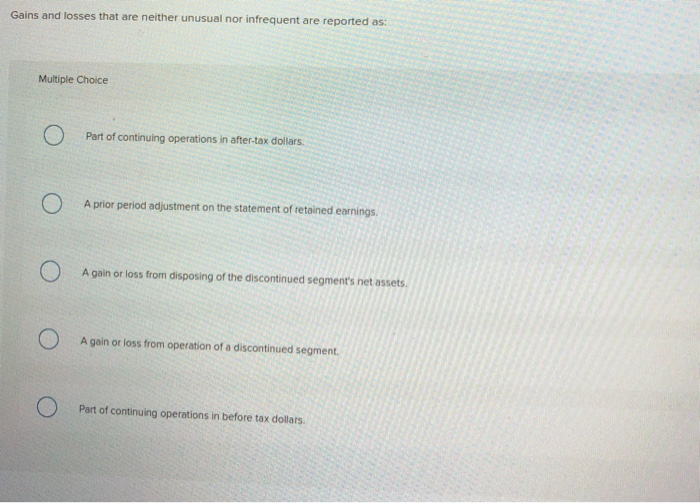

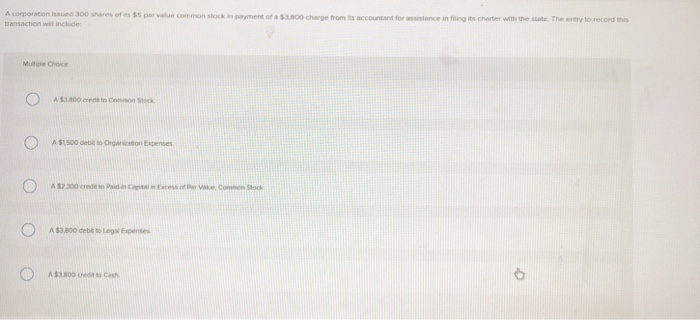

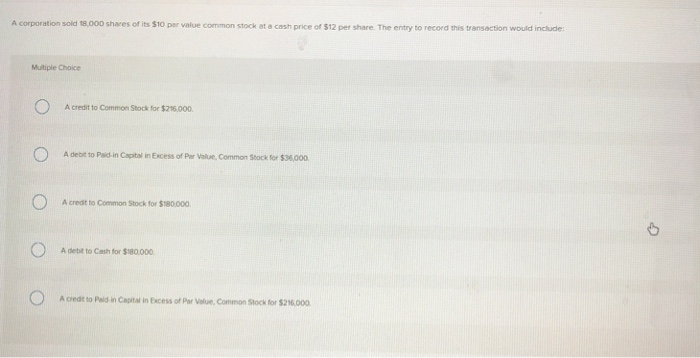

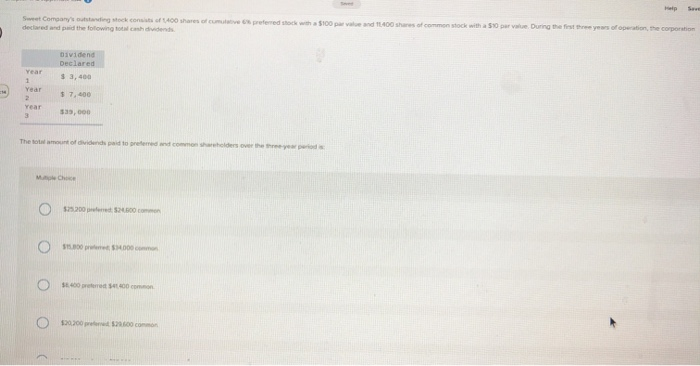

Stocks that pay relatively large cash dividends on a regular basis are called: Multiple Choice Small capital stocks. Mid capital stocks. Growth stocks. Large capital stocks. Income stocks. The amount of annual cash dividends distributed to common shareholders relative to the common stock's market value is the: Multiple Choice Dividend payout ratio Dividend yield Price-earnings ratio. Current yield Earnings per share. Corporations may buy back their own stock for any of the following reasons except to: Multiple Choice Avoid a hostile take-over. Have shares available fora merger or acquisition. Have shares available for employee compensation. Maintain market value for the company stock Allow management to assume the voting rights. A corporation's minimum legal capital is established by recording the par or stated value of the number of shares: Multiple Choice Issued. #1 Authorized. Subscribed Outstanding In treasury Prior to June 30, a company has never had any treasury stock transactions. A company repurchased 100 shares of its common stock on June 30 for $40 per share. On July 20, it reissued 50 of these shares at $46 per share. Orn August 1, it reissued 20 of the shares at $38 per share. What is the balance in the Treasury Stock account on August 27 Mutple Choce $5,050 $2.600 $100 S1200 $0 ! Comfort Mattresses, Inc sold 26,000 shares of its $1 par value common stock at a cash price of $12 per share. The entry to record this transaction would be: Multiple Choice Debit Cash $312.000 credit Common Stock $26,000, credit Paid in Capital in Excess of Par Value, Common Stock $286,000 Debit Cash for $312,000, credit Common Stock $312,000 Debit Common Stock $26.000, debit Paid-in Capital in Excess of Par Value, Common Stock $286.000 credit Cash $312.000 Debit Cash $312.000, credt Stock Liability $286,000 credit Common Stock $26,000 Debit Common Stock $26.000: credit Cash $26.000 Gains and losses that are neither unusual nor infrequent are reported as: Multiple Choice Part of continuing operations in after-tax dollars A prior period adjustment on the statement of retained earnings. A gain or loss from disposing of the discontinued segment's net assets A gain or loss from operation of a discontinued segment. Part of continuing operations in before tax dollars. A corporation issued 300 shares of s $5 par value common stock in payment of a $3.800 cherge from ts accountant for assistance in filing its charter with the state. The entry to recoed this transaction wil include Multige Choice A $3800 ede to Common Stock A $1500 debit to Orgarication Expenses A $2.300 crede to Paid in Ceptal in Ecess of Par Vae Common Stock A $3,800 debit to Legal Expenses A $3800 credt to Cash A corporation sold 18,000 shares of its $10 par value common stock at a cash price of $12 per share. The entry to record this transaction would include: Multiple Choice A credit to Common Stock for $216.000 A debit to Paid-in Capital in Excess of Par Value, Common Stock for $36,000 A credt to Common Stock for $180000 A debit to Cash for $180 000 A credt to Pald in Capital in Ecess of Par Value, Common Stock for $216.000 Seet Help Save Sweet Company's outstanding stock consiats of 1,400 shares of cumulative 6% prefered shock with a $I00 par value and 11.400 shanes of commen stock with a $0 par value During the first three years of operation, the corporstion declared and paid the folowing total canh dividends 01vidend Declared Year S3,400 1 Year $ 7,400 2 Year $33, 000 3 The total amount of dvidends paid to prefermed and common shareholders over the three-year perod i Muple Chice $25200 peed $2400 cmmon $800 preed $34000 common O 00retemed s00mmon $20,200 p d $2600 common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts