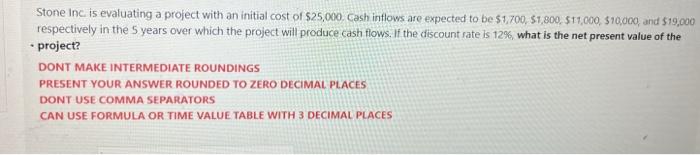

Question: Stone Inc is evaluating a project with an initial cost of $25,000. Cash inflows are expected to be $1,700,$1,800,511,000,$10,000, and $19,000 respectively in the 5

Stone Inc is evaluating a project with an initial cost of $25,000. Cash inflows are expected to be $1,700,$1,800,511,000,$10,000, and $19,000 respectively in the 5 years over which the project will produce cash flows. If the discount rate is 12%, what is the net present value of the - project? DONT MAKE INTERMEDIATE ROUNDINGS PRESENT YOUR ANSWER ROUNDED TO ZERO DECIMAL PLACES DONT USE COMMA SEPARATORS CAN USE FORMULA OR TIME VALUE TABLE WITH 3 DECIMAL PLACES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts