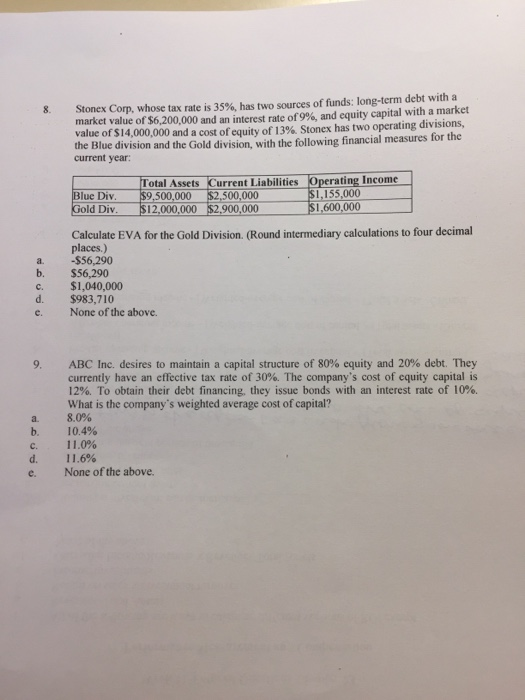

Question: Stonex Corp. whose tax rate is 35%, has two sources of funds: long-term debt with a market value of $6,200,000 and an interest rate of996,

Stonex Corp. whose tax rate is 35%, has two sources of funds: long-term debt with a market value of $6,200,000 and an interest rate of996, and equity capital with a market value of S 14,000,000 and a cost of equity of 13%, Stones has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year: Total Assets Current Liabilities Operating Income Blue Div. 9,500,000 2,500,000 Gold Div. $12,000,000 $2,900,000 1,155,000 BL,600,000 Calculate EVA for the Gold Division. (Round intermediary calculations to four decimal places.) a. $56,290 b. $56,290 c. $1,040,000 d. $983,710 e. None of the above. a. b. C. d. e. ABC Inc. desires to maintain a capital structure of 80% equity and 20% debt. They currently have an effective tax rate of 30%. The company's cost of cquity capital is 12%. To obtain their debt financing, they issue bonds with an interest rate of 10%. What is the company's weighted average cost of capital? 8.096 104% 11.0% 11.6% None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts