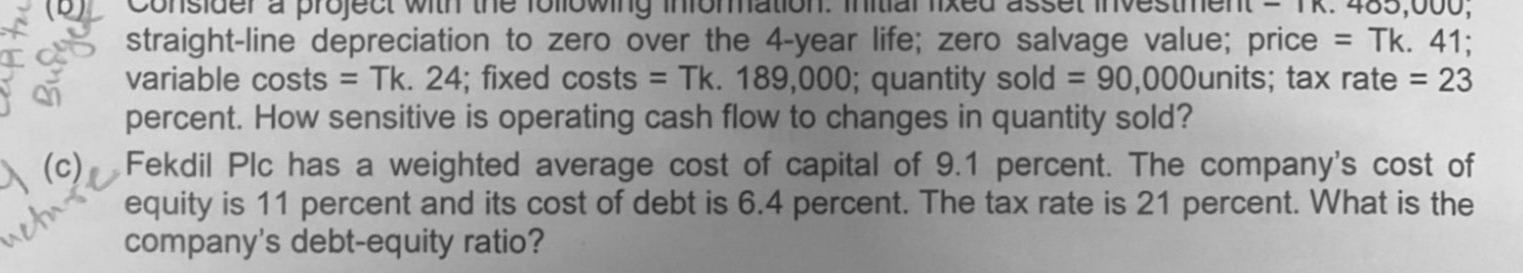

Question: straight - line depreciation to zero over the 4 - year life; zero salvage value; price = Tk . 4 1 ; variable costs =

straightline depreciation to zero over the year life; zero salvage value; price Tk ; variable costs Tk; fixed costs Tk; quantity sold units; tax rate percent. How sensitive is operating cash flow to changes in quantity sold?

c Fekdil Plc has a weighted average cost of capital of percent. The company's cost of equity is percent and its cost of debt is percent. The tax rate is percent. What is the company's debtequity ratio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock