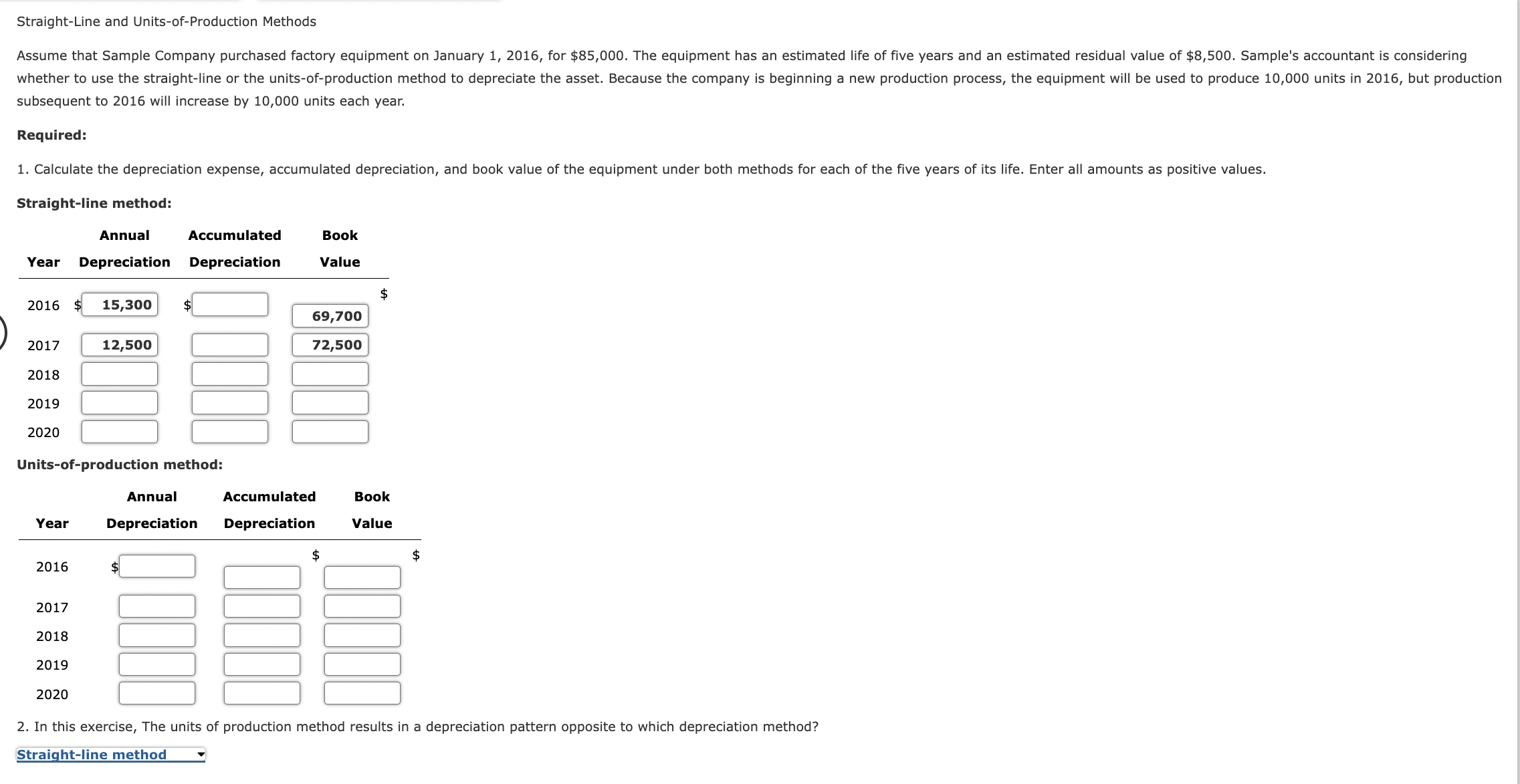

Question: Straight-Line and Units-of-Production Methods subsequent to 2016 will increase by 10,000 units each year. Required: 1. Calculate the depreciation expense, accumulated depreciation, and book value

Straight-Line and Units-of-Production Methods subsequent to 2016 will increase by 10,000 units each year. Required: 1. Calculate the depreciation expense, accumulated depreciation, and book value of the equipment under both methods for each of the five years of its life. Enter all amounts as positive values. Straight-line method: 2. In this exercise, The units of production method results in a depreciation pattern opposite to which depreciation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts