Question: straight-line double diminishing-balance units-of-production c. Which method would result in the highest profit for the year ended September 30, 2021? Over the life of the

straight-line

double diminishing-balance

units-of-production

c. Which method would result in the highest profit for the year ended

September 30, 2021? Over the life of the asset?

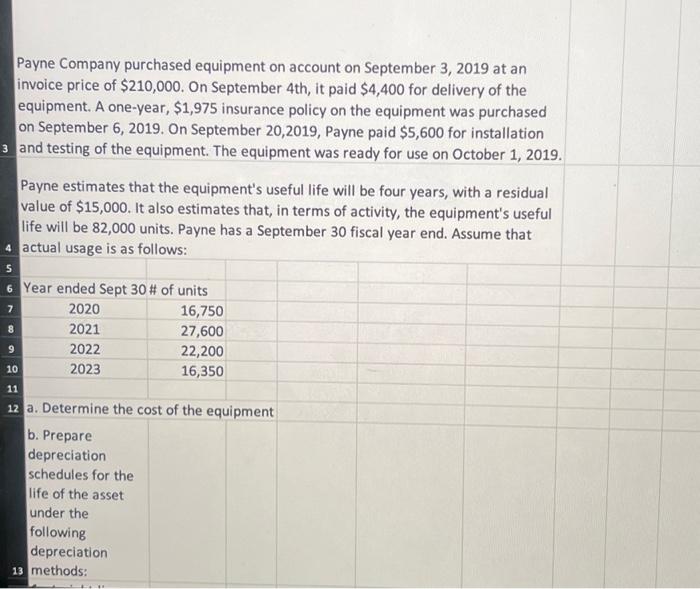

Payne Company purchased equipment on account on September 3, 2019 at an invoice price of \\( \\$ 210,000 \\). On September 4 th, it paid \\( \\$ 4,400 \\) for delivery of the equipment. A one-year, \\( \\$ 1,975 \\) insurance policy on the equipment was purchased on September 6, 2019. On September 20,2019, Payne paid \\( \\$ 5,600 \\) for installation and testing of the equipment. The equipment was ready for use on October 1, 2019. Payne estimates that the equipment's useful life will be four years, with a residual value of \\( \\$ 15,000 \\). It also estimates that, in terms of activity, the equipment's useful life will be 82,000 units. Payne has a September 30 fiscal year end. Assume that actual usage is as follows: a. Determine the cost of the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts