Question: STRAIGHTLINE TEMPLATE TABLE: NOT ACTUAL PROBLEM NUMBERS PRESENTED IN TABLE. DECLINING TABLE TEMPLATE: DO NOT USE NUMBERS PRESENTED IN TABLE NOTE: THIS IS ALL ONE

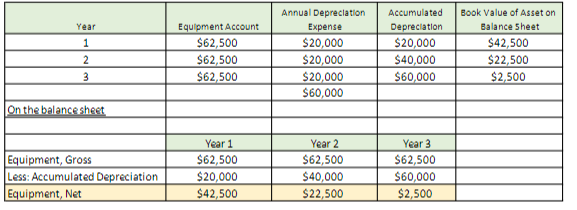

STRAIGHTLINE TEMPLATE TABLE: NOT ACTUAL PROBLEM NUMBERS PRESENTED IN TABLE.

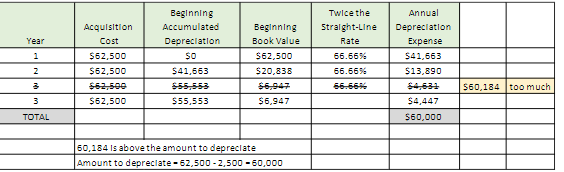

DECLINING TABLE TEMPLATE: DO NOT USE NUMBERS PRESENTED IN TABLE

NOTE: THIS IS ALL ONE QUESTION NOT SEPERATE QUESTIONS

PLEASE HELP CALCULATE THIS PROBLEM

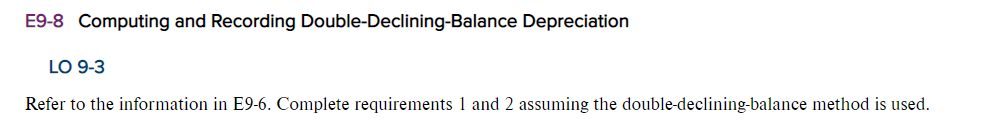

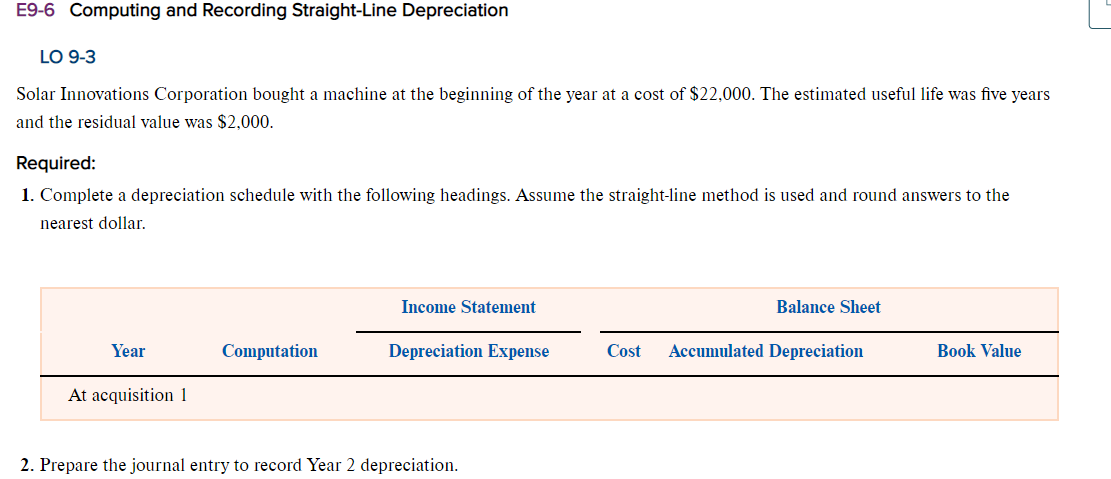

E9-8 Computing and Recording Double-Declining-Balance Depreciation LO 9-3 Refer to the information in E9-6. Complete requirements 1 and 2 assuming the double-declining-balance method is used. E9-6 Computing and Recording Straight-Line Depreciation LO 9-3 Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $22,000. The estimated useful life was five years and the residual value was $2,000. Required: 1. Complete a depreciation schedule with the following headings. Assume the straight-line method is used and round answers to the nearest dollar. Income Statement Balance Sheet Year Computation Depreciation Expense Cost Accumulated Depreciation Book Value At acquisition 1 2. Prepare the journal entry to record Year 2 depreciation. Year 1 Equipment Account $62,500 $62,500 $62,500 Annual Depreciation Expense $20,000 $20,000 $20,000 $60,000 Accumulated Depreciation $20,000 $40,000 $60,000 Book Value of Asset on Balance Sheet $42,500 $22,500 $2.500 2 3 On the balance sheet Equipment, Gross Less: Accumulated Depreciation Equipment, Net Year 1 $62,500 $20,000 $42,500 Year 2 $62,500 $40,000 $22,500 Year 3 $62,500 $60,000 $2,500 Year Acquisition Cost $62,500 $62,500 $62,500 $62,500 Beginning Accumulated Depreciation $o $41,563 $55,553 $55,553 1 2 Twice the Straight-Line Rate 66.56% 66.665 66.66 Beginning Book Value $62,500 $20,838 $6,947 $6,947 Annual Depreciation Expense $41,563 $13,890 560,184 too much 3 $4,447 $60,000 TOTAL 50,184 Is above the amount to depreciate Amount to depreciate - 62,500 -2,500 - 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts