Question: strategic managment course. topic : Business re-engreeing program e DIVISIONAL PERFORMANCE MEASURMENT.pdf - Adobe Reader File Edt View Window Help Open VOS Tools Fill &

strategic managment course.

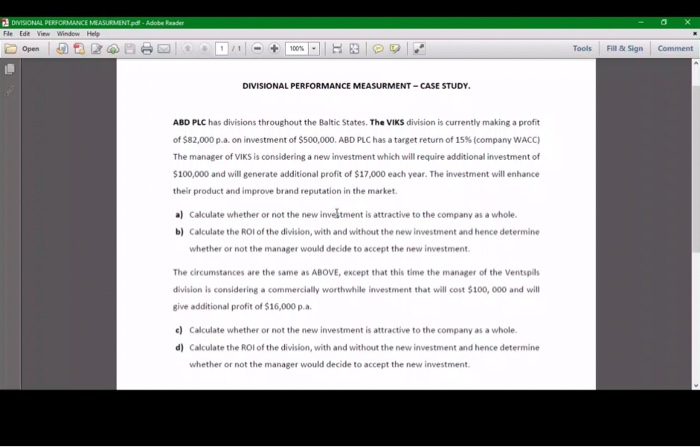

e DIVISIONAL PERFORMANCE MEASURMENT.pdf - Adobe Reader File Edt View Window Help Open VOS Tools Fill & Sign Comment DIVISIONAL PERFORMANCE MEASURMENT - CASE STUDY. ABD PLC has divisions throughout the Baltic States. The VIKS division is currently making a profit of $82,000 p.a. on investment of $500,000. ABD PLC has a target return of 15% (company WACC) The manager of VIKS is considering a new investment which will require additional investment of $100,000 and will generate additional profit of $17,000 each year. The investment will enhance their product and improve brand reputation in the market. a) Calculate whether or not the new invetment is attractive to the company as a whole. b) Calculate the Rol of the division, with and without the new investment and hence determine whether or not the manager would decide to accept the new investment The circumstances are the same as ABOVE, except that this time the manager of the Ventspils division is considering a commercially worthwhile investment that will cost $100,000 and will give additional profit of $16,000 p.a. c) Calculate whether or not the new investment is attractive to the company as a whole. d) Calculate the Rol of the division, with and without the new investment and hence determine whether or not the manager would decide to accept the new investment topic :

Business re-engreeing program

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock