Question: Strategic Processing Plant Project Brightstar Resources (BTR) is an emerging gold explorers and near-term developers in Western Australia. As an Exploration Manager for the company

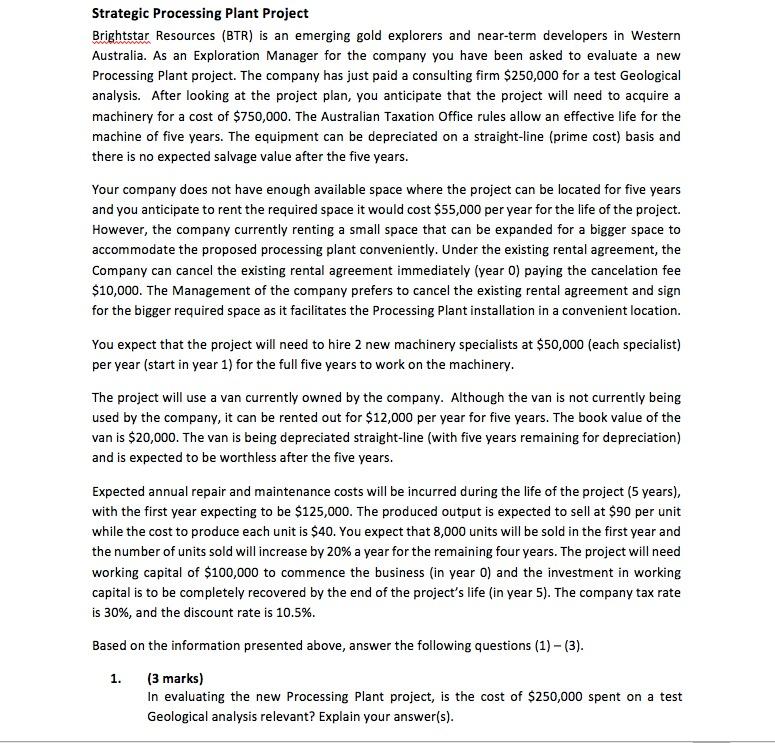

Strategic Processing Plant Project Brightstar Resources (BTR) is an emerging gold explorers and near-term developers in Western Australia. As an Exploration Manager for the company you have been asked to evaluate a new Processing Plant project. The company has just paid a consulting firm $250,000 for a test Geological analysis. After looking at the project plan, you anticipate that the project will need to acquire a machinery for a cost of $750,000. The Australian Taxation Office rules allow an effective life for the machine of five years. The equipment can be depreciated on a straight-line (prime cost) basis and there is no expected salvage value after the five years. Your company does not have enough available space where the project can be located for five years and you anticipate to rent the required space it would cost $55,000 per year for the life of the project. However, the company currently renting a small space that can be expanded for a bigger space to accommodate the proposed processing plant conveniently. Under the existing rental agreement, the Company can cancel the existing rental agreement immediately (year 0) paying the cancelation fee $10,000. The Management of the company prefers to cancel the existing rental agreement and sign for the bigger required space as it facilitates the Processing Plant installation in a convenient location. You expect that the project will need to hire 2 new machinery specialists at $50,000 (each specialist) per year (start in year 1) for the full five years to work on the machinery. The project will use a van currently owned by the company. Although the van is not currently being used by the company, it can be rented out for $12,000 per year for five years. The book value of the van is $20,000. The van is being depreciated straight-line (with five years remaining for depreciation) and is expected to be worthless after the five years. Expected annual repair and maintenance costs will be incurred during the life of the project (5 years), with the first year expecting to be $125,000. The produced output is expected to sell at $90 per unit while the cost to produce each unit is $40. You expect that 8,000 units will be sold in the first year and the number of units sold will increase by 20% a year for the remaining four years. The project will need working capital of $100,000 to commence the business (in year 0) and the investment in working capital is to be completely recovered by the end of the project's life (in year 5). The company tax rate is 30%, and the discount rate is 10.5%. Based on the information presented above, answer the following questions (1) - (3). 1. (3 marks) In evaluating the new Processing Plant project, is the cost of $250,000 spent on a test Geological analysis relevant? Explain your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts