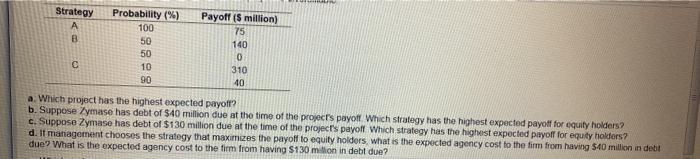

Question: Strategy A B Payoff (5 million) 75 Probability (%) 100 50 50 10 90 140 C 0 310 40 a. Which project has the highest

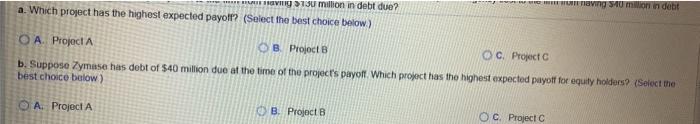

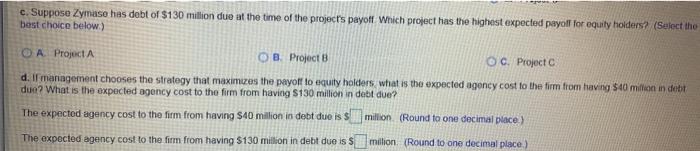

Strategy A B Payoff (5 million) 75 Probability (%) 100 50 50 10 90 140 C 0 310 40 a. Which project has the highest expected payoff? b. Suppose Zymase has debt of $40 million due at the time of the projects payoff Which strategy has the highest expected payoff for equity holders? c. Suppose Zymase has debt of $130 million due at the time of the project's payoff Which strategy has the highest expected payoff for equity holders? d. It management chooses the strategy that maximizes the payoff to equity holders, what is the expected agency cost to the firm from having $10 million in debt due? What is the expected agency cost to the firm from having $130 million in debt due? HIVIU >30 million in debt due? - Coving so milion in debt a. Which project has the highest expected payoff? (Select the best choice below) OA Project OB Project B OC. Project b. Suppose Zymase has debt of 540 million due at the time of the project's payoff. Which project has the highest expected payotf for equity holders? (Select the best choice below) A Project A OB Project B OC. Project c. Suppose Zymuse has debt of $130 million due at the time of the project's payoff Wnich project has the highest expected payoff for equity holders? (Select the best choice below) OA Project 8. Project OC. Project d. If management chooses the strategy that maximizes the payoff to equity holders what is the expected agency cost to the firm from having $40 million in dett due? What is the expected agency cost to the firm from having S130 million in debt due? The expected agency cost to the firm from having $40 million in debt due is $ million (Round to one decimal place) The expected agency cost to the firm from having $130 million in debt due iss million (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts