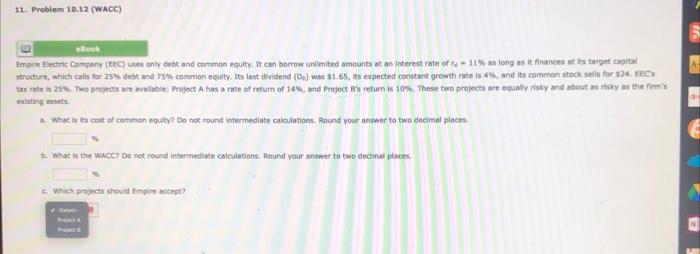

Question: structure, which calls for 25% debt and 75%h common equity. Its last dividend (De) was $1.65, its expected constank growth rate is 4%, and its

structure, which calls for 25% debt and 75\%h common equity. Its last dividend (De) was $1.65, its expected constank growth rate is 4%, and its common stack selis for $24. EFC. tax ente is 25 h. Two proyects are avaliable: Praject A has a rate of return of 14\%, and Project B's return is 10%. These two nrojects are equally risky and abeut as rishy as the firm's existing wasets. A. What is fis cont of common equity? Do not round intermediate calculations. Round your angwer to two decimal pilaces. b. What is the Whach De not round intermediste calculabions. Round your answer to two decimal places, c. Whiet projects should tmpire sctept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts