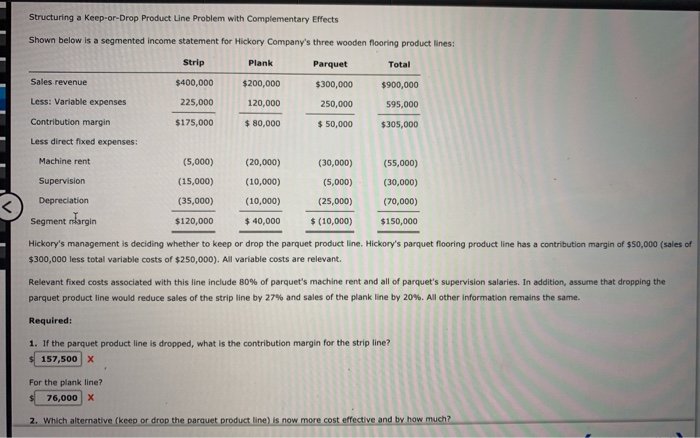

Question: Structuring a keep-or-Drop Product Line Problem with Complementary Effects Shown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip

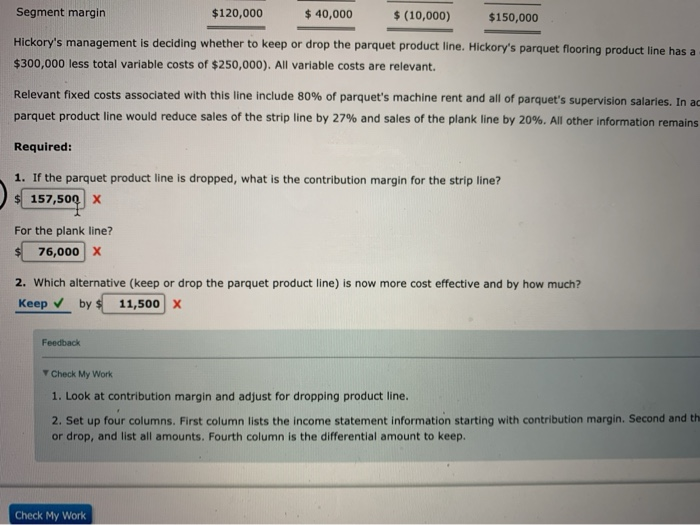

Structuring a keep-or-Drop Product Line Problem with Complementary Effects Shown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip Plank Parquet Total Sales revenue $400,000 $300,000 $900,000 $200,000 120,000 Less: Variable expenses 225,000 250,000 595,000 $305,000 Contribution margin $175,000 $ 80,000 $ 50,000 Less direct fixed expenses: Machine rent (5,000) (20,000) (30,000) (55,000) Supervision (15,000) (10,000) (5,000) (30,000) Depreciation (35,000) (10,000) (25,000) (70,000) Segment nlargin $120,000 $ 40,000 $ (10,000) $150,000 Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a contribution margin of $50,000 (sales of $300,000 less total variable costs of $250,000). All variable costs are relevant. Relevant fixed costs associated with this line include 80% of parquet's machine rent and all of parquet's supervision salaries. In addition, assume that dropping the parquet product line would reduce sales of the strip line by 27% and sales of the plank line by 20%. All other Information remains the same. Required: 1. If the parquet product line is dropped, what is the contribution margin for the strip line? 157,500 X For the plank line? 76,000 X 2. Which alternative (keep or drop the parquet product line) is now more cost effective and by how much? Segment margin $120,000 $ 40,000 $ (10,000) $150,000 Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a $300,000 less total variable costs of $250,000). All variable costs are relevant Relevant fixed costs associated with this line include 80% of parquet's machine rent and all of parquet's supervision salaries. In ac parquet product line would reduce sales of the strip line by 27% and sales of the plank line by 20%. All other information remains Required: 1. If the parquet product line is dropped, what is the contribution margin for the strip line? 157,500 For the plank line? 76,000 x 2. Which alternative (keep or drop the parquet product line) is now more cost effective and by how much? Keep V by $ 11,500 X Feedback Check My Work 1. Look at contribution margin and adjust for dropping product line. 2. Set up four columns. First column lists the income statement information starting with contribution margin. Second and the or drop, and list all amounts. Fourth column is the differential amount to keep. Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts