Question: struggling to figure this out. please help (2) Consider a stock with a current price of $100 that will over the next year, increase in

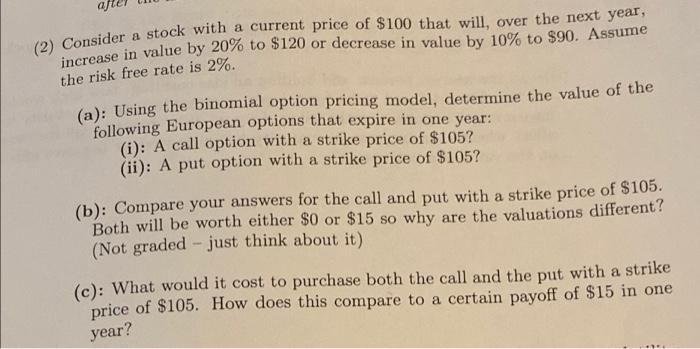

(2) Consider a stock with a current price of $100 that will over the next year, increase in value by 20% to $120 or decrease in value by 10% to 890. Assume the risk free rate is 2%. a (a): Using the binomial option pricing model, determine the value of the following European options that expire in one year: (i): A call option with a strike price of $105? (ii): A put option with a strike price of $105? (b): Compare your answers for the call and put with a strike price of $105. Both will be worth either $0 or $15 so why are the valuations different? (Not graded - just think about it) (c): What would it cost to purchase both the call and the put with a strike price of $105. How does this compare to a certain payoff of $15 in one year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts