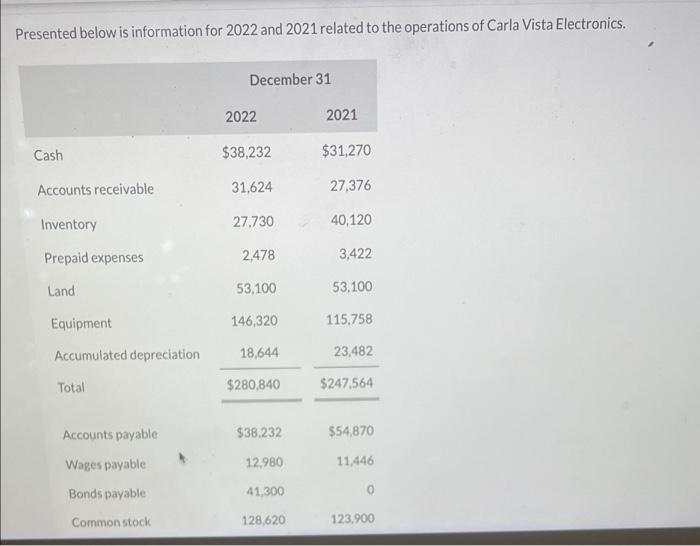

Question: struggling to learn how this works- please help Presented below is information for 2022 and 2021 related to the operations of Carla Vista Electronics. December

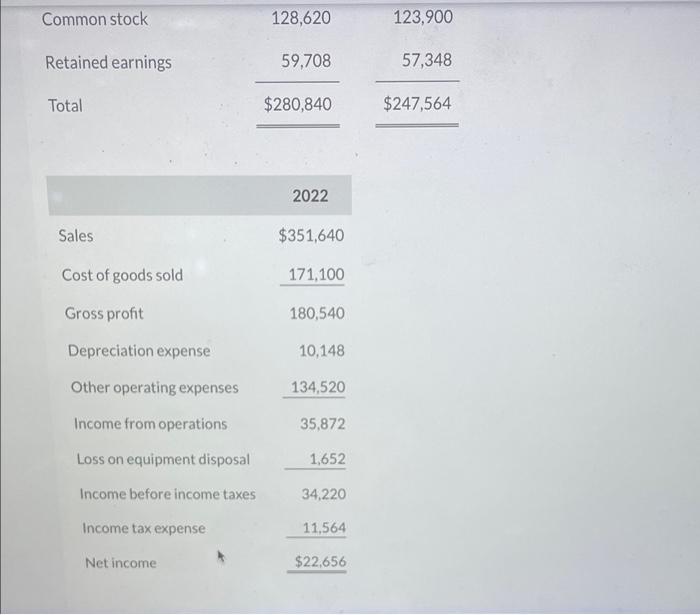

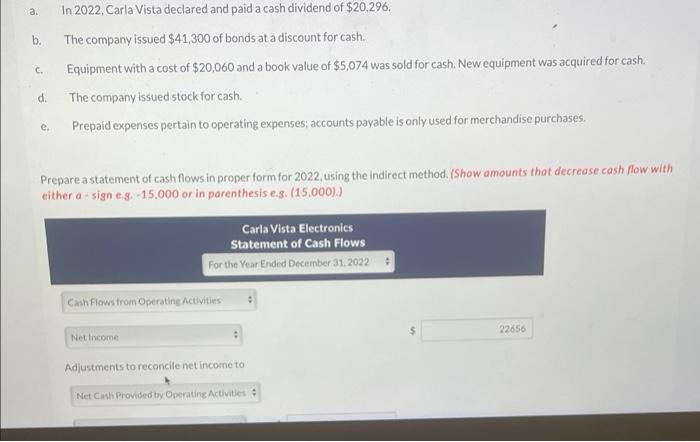

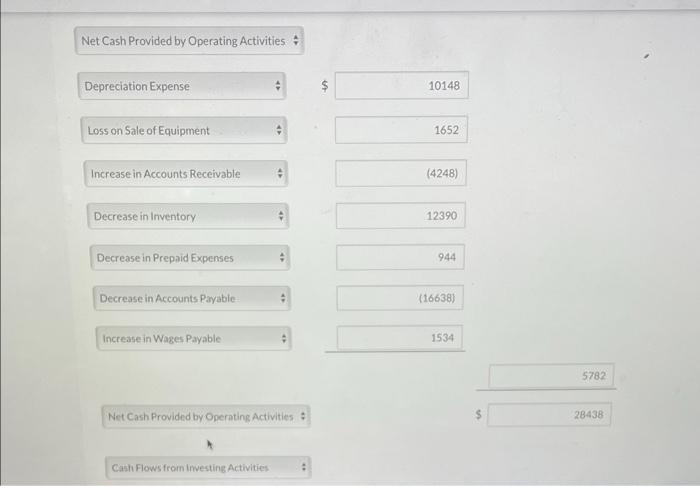

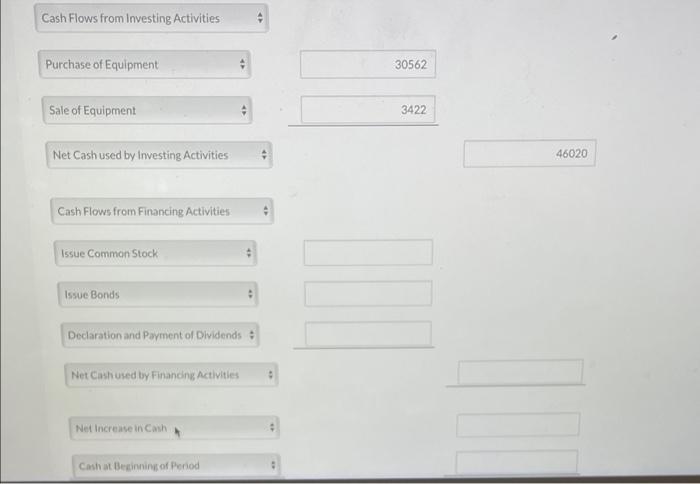

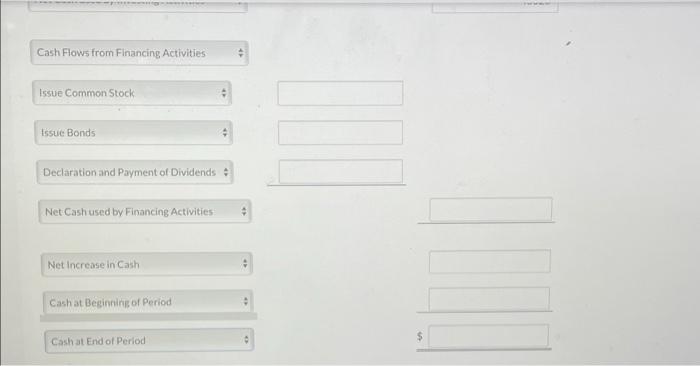

Presented below is information for 2022 and 2021 related to the operations of Carla Vista Electronics. December 31 2022 2021 Cash $38,232 $31,270 Accounts receivable 31,624 27,376 Inventory 27.730 40,120 Prepaid expenses 2,478 3,422 Land 53,100 53,100 Equipment 146,320 115.758 Accumulated depreciation 18,644 23.482 Total $280,840 $247.564 Accounts payable $38,232 $54,870 Wages payable 12,980 11.446 41.300 0 Bonds payable Common stock 128,620 123.900 Common stock 128,620 123,900 Retained earnings 59,708 57,348 Total $280,840 $247,564 2022 Sales $351,640 171.100 Cost of goods sold Gross profit Depreciation expense 180,540 10,148 Other operating expenses 134,520 Income from operations 35,872 1,652 Loss on equipment disposal Income before income taxes Income tax expense 34,220 11,564 Net income $22,656 a. b. C. In 2022, Carla Vista declared and paid a cash dividend of $20,296, The company issued $41,300 of bonds at a discount for cash. Equipment with a cost of $20,060 and a book value of $5,074 was sold for cash. New equipment was acquired for cash. The company issued stock for cash. Prepaid expenses pertain to operating expenses; accounts payable is only used for merchandise purchases. d. e. Prepare a statement of cash flows in proper form for 2022, using the Indirect method. (Show amounts that decrease cash flow with either a - sign 4,8 -15,000 or in parenthesis e.3. (15,000).) Carla Vista Electronics Statement of Cash Flows For the Year Ended December 31, 2022 : Cash Flows from Operating Activities 22656 Net Income Adjustments to reconcile net income to Net Cash Provided try Operating Activities Net Cash Provided by Operating Activities Depreciation Expense $ 10148 Loss on Sale of Equipment 1652 Increase in Accounts Receivable (4248) Decrease in Inventory 12390 Decrease in Prepaid Expenses 944 Decrease in Accounts Payable (16638) Increase in Wages Payable 1534 5782 Net Cash Provided by Operating Activities : 28438 Cash Flows from investing Activities Cash Flows from Investing Activities Purchase of Equipment 30562 Sale of Equipment 3422 Net Cash used by Investing Activities 46020 Cash Flows from Financing Activities Issue Common Stock Issue Bonds Declaration and Payment of Dividends : Net Cash used by Financing Activities Net Increase in Cash Cash at Besinning of Period Cash Flows from Financing Activities Issue Common Stock Issue Bonds Declaration and Payment of Dividends Net Cash used by Financing Activities Net Increase in Cash Cash at Beginning of Period $ Cash at End of Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts