Question: stuck in this solve the problem SAP id 70060187 solve part a Question 1: (15) (a) Arbitrage Pricing Theory is considered as an extension of

stuck in this solve the problem SAP id 70060187 solve part a

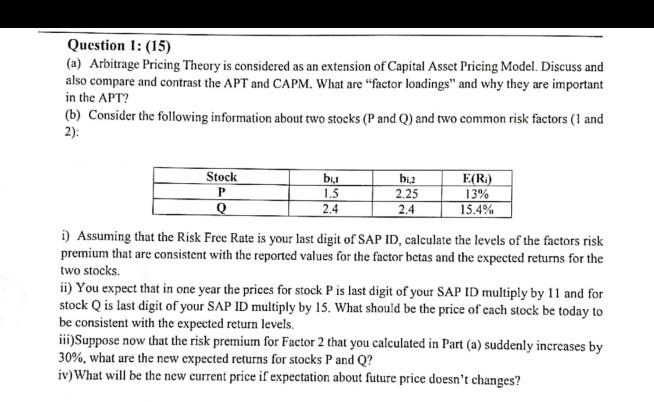

Question 1: (15) (a) Arbitrage Pricing Theory is considered as an extension of Capital Asset Pricing Model. Discuss and also compare and contrast the APT and CAPM. What are "factor loadings" and why they are important in the APT? (b) Consider the following information about two stocks (P and Q) and two common risk factors (1 and 2): Stock P Q but 1.5 2.4 bu 2.25 2.4 E(Ri) 13% 15.4% 1) Assuming that the Risk Free Rate is your last digit of SAP ID, calculate the levels of the factors risk premium that are consistent with the reported values for the factor hetas and the expected returns for the two stocks. ii) You expect that in one year the prices for stock P is last digit of your SAP ID multiply by 11 and for stock Q is last digit of your SAP ID multiply by 15. What should be the price of each stock be today to be consistent with the expected return levels. iii)Suppose now that the risk premium for Factor 2 that you calculated in Part (a) suddenly increases by 30%, what are the new expected returns for stocks P and Q? iv) What will be the new current price i expectation about future price doesn't changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts