Question: stuck need help trying to recall how to do the calculations On January 1 . Sharp Company purchased $40,000 of Sox Company 6% bonds, at

stuck need help trying to recall how to do the calculations

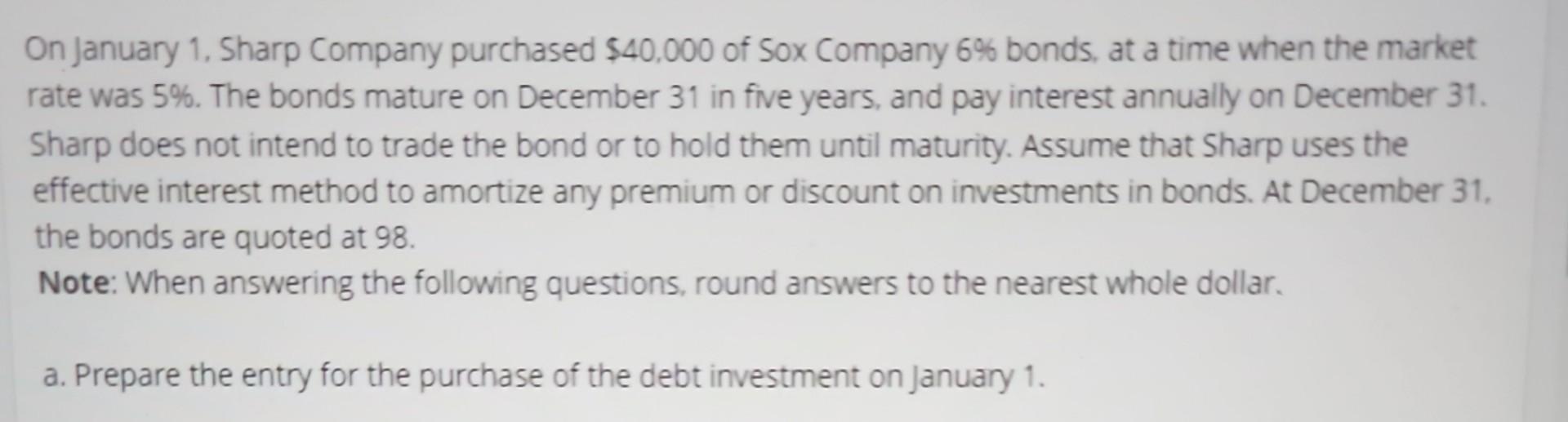

On January 1 . Sharp Company purchased $40,000 of Sox Company 6% bonds, at a time when the market rate was 5\%. The bonds mature on December 31 in five years, and pay interest annually on December 31. Sharp does not intend to trade the bond or to hold them until maturity. Assume that Sharp uses the effective interest method to amortize any premium or discount on investments in bonds. At December 31 , the bonds are quoted at 98. Note: When answering the following questions, round answers to the nearest whole dollar. a. Prepare the entry for the purchase of the debt investment on January 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts