Question: Stuck on both question #1 and #2, Chau Enterprises problem and Sealey Farm October 19 Accountancy 325-Fall 2017 Problem 1 Chau Enterprises, a multi-location printing

Stuck on both question #1 and #2, Chau Enterprises problem and Sealey Farm

Stuck on both question #1 and #2, Chau Enterprises problem and Sealey Farm

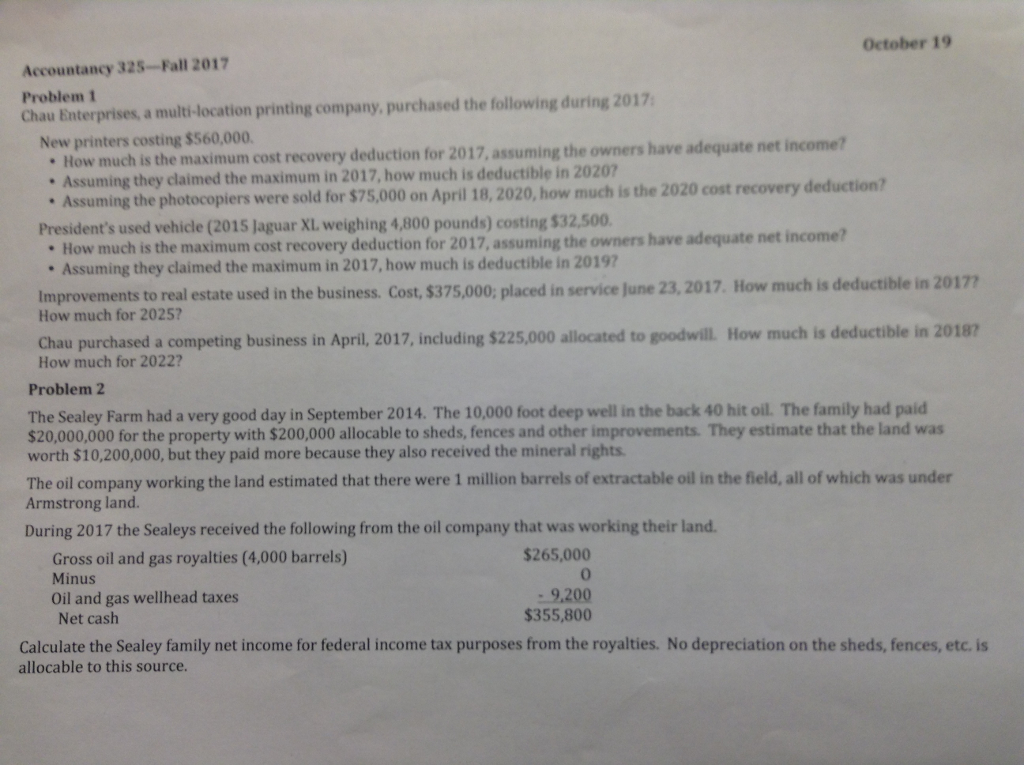

October 19 Accountancy 325-Fall 2017 Problem 1 Chau Enterprises, a multi-location printing company, purchased the following during 2017 New printers costing $560,000 How much is the maximum cost recovery deduction for 2017, assuming the owners have Assuming they claimed the maximum in 2017, how much is deductible in 20207 Assuming the photocopiers were sold for $75,000 on April 18,2020, how much is the 2020 cost recovery deduction? President's used vehicle (2015 Jaguar XI weighing 4,800 pounds) costing $32,500 How much is the maximum cost recovery deduction for 2017, assuming the owners have adequate net . Assuming they claimed the maximum in 2017, how much is deductible in 20197 Improvements to real estate used in the business. Cost, $375,000 placed in service June 23,2017. How much is deductible in 2017 How much for 2025? Chau purchased a competing business in April, 2017, including $225.000 allocated to goodwill How much is deductible in 20187 How much for 2022? Problem 2 The Sealey Farm had a very good day in September 2014. The 10,000 foot deep well in the back 40 hit oil. The family had paid $20,000,000 for the property with $200,000 allocable to sheds, fences and other improvements. They estimate that the land was worth $10,200,000, but they paid more because they also received the mineral rights The oil company working the land estimated that there were 1 million barrels of extractable oil in the field, all of which was under Armstrong land. During 2017 the Sealeys received the following from the oil company that was working their land $265,000 Gross oil and gas royalties(4,000 barrels) Minus Oil and gas wellhead taxes Net cash : 9,200 $355,800 Calculate the Sealey family net income for federal income tax purposes from the royalties. No depreciation on the sheds, fences, etc. is allocable to this source. October 19 Accountancy 325-Fall 2017 Problem 1 Chau Enterprises, a multi-location printing company, purchased the following during 2017 New printers costing $560,000 How much is the maximum cost recovery deduction for 2017, assuming the owners have Assuming they claimed the maximum in 2017, how much is deductible in 20207 Assuming the photocopiers were sold for $75,000 on April 18,2020, how much is the 2020 cost recovery deduction? President's used vehicle (2015 Jaguar XI weighing 4,800 pounds) costing $32,500 How much is the maximum cost recovery deduction for 2017, assuming the owners have adequate net . Assuming they claimed the maximum in 2017, how much is deductible in 20197 Improvements to real estate used in the business. Cost, $375,000 placed in service June 23,2017. How much is deductible in 2017 How much for 2025? Chau purchased a competing business in April, 2017, including $225.000 allocated to goodwill How much is deductible in 20187 How much for 2022? Problem 2 The Sealey Farm had a very good day in September 2014. The 10,000 foot deep well in the back 40 hit oil. The family had paid $20,000,000 for the property with $200,000 allocable to sheds, fences and other improvements. They estimate that the land was worth $10,200,000, but they paid more because they also received the mineral rights The oil company working the land estimated that there were 1 million barrels of extractable oil in the field, all of which was under Armstrong land. During 2017 the Sealeys received the following from the oil company that was working their land $265,000 Gross oil and gas royalties(4,000 barrels) Minus Oil and gas wellhead taxes Net cash : 9,200 $355,800 Calculate the Sealey family net income for federal income tax purposes from the royalties. No depreciation on the sheds, fences, etc. is allocable to this source

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts