Question: stuck on these. please explain how to get the answer thank you 3. Phoenix Company common stock is currently selling for $20 per share. Security

stuck on these. please explain how to get the answer thank you

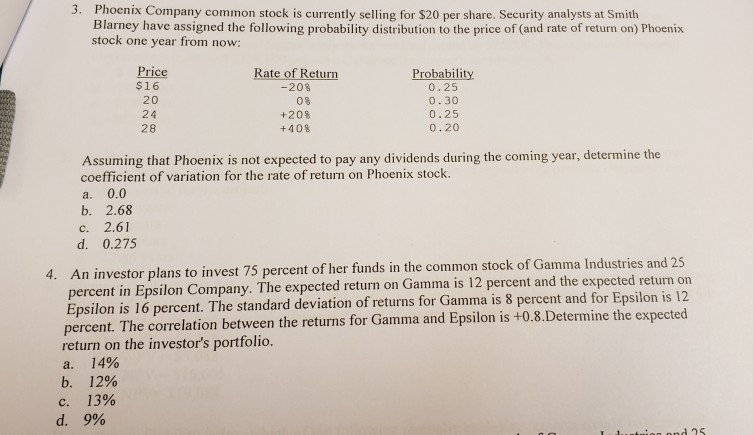

3. Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now: Price $16 20 24 28 Rate of Return -20% Probability 0.25 0.30 0.25 0.20 0% +20% +40% Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock. a. 0.0 b. 2.68 c. 2.61 d. 0.275 4. An investor plans to invest 75 percent of her funds in the common stock of Gamma Industries and 25 nt in Epsilon Company. The expected return on Gamma is 12 percent and the expected return on or Epsilon is 12 Epsilon is 16 percent. The standard deviation of returns for Gamma is 8 percent and f percent. The correlation between the returns return on the investor's portfolio a. 14% b. 12% . 13% d. 9% for Gamma and Epsilon is +0.8. Determine the expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts