Question: stuck on this engineering econ probelm Chapter 5-Evaluating a Single Project- Equivalent Worth Methods Engineering Economics (1) Homework: Chapter 5- Evaluating a Single Project -

stuck on this engineering econ probelm

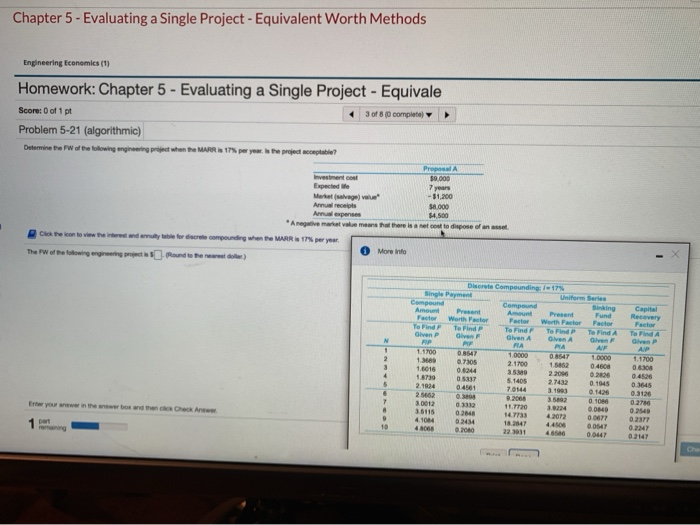

stuck on this engineering econ probelm Chapter 5-Evaluating a Single Project- Equivalent Worth Methods Engineering Economics (1) Homework: Chapter 5- Evaluating a Single Project - Equivale 3 of 8 (0 complete) Score: 0 of 1 pt Problem 5-21 (algorithmic) Detemine the FW of the tolowing engineering priject when the MARR is 17% per year is he project acceptable? Propesal A S9.000 7 years $1,200 Investment cost Expected e Market (salvage) value Anual receipts Anual expenses s8.000 $4.500 A negalive market value means that there is a net cost to dispose of an asset Cick the con to view the interest and amuty table for dscrete compounding when the MARR is 17 % per year More Info The FW of the falowing engineering project is Round to the nearest doller Discrete Compounding /17 % Single Payment Compound Amount Factor Te Find Given P Uniferm Series Compound Amount Factor To Find F Given A Sinking Fund Factor Te Find A Given F AIF 1.0000 0.4608 0.2826 0.1945 0.1426 0.1086 0.0849 0.0677 0.0547 0.0447 Capital Recovery Factor Te Find A Present Worth Factor To Find P Given F PIF Present Werth Factor To Find P Given A Given P AIP N RP RA PIA 1.1700 13609 16016 1.8739 O8647 07305 0.6244 0.5337 1.0000 08547 1.1700 0.6308 04526 0.3645 03126 2 2.1700 15862 2.2096 2.7432 3.1993 3.5892 3.5389 4 5.1405 5 2.1924 04561 7.0144 2.5662 0.3808 0.3332 02848 02434 02080 9.2068 0.2780 7 30012 11.7720 14.7733 3.8224 0.2549 02377 0.2247 Enter your answer in the answer box and then cck Check Answ 3.511 4.1084 4.8068 42072 44506 18.2047 1 art maining 10 22.3931 4.6586 02147 Che

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts