Question: stuck on this part it is double declining method got up to there but keep getting stuck. Required: 1. Complete a separate depreciation schedule for

stuck on this part it is double declining method got up to there but keep getting stuck.

stuck on this part it is double declining method got up to there but keep getting stuck.

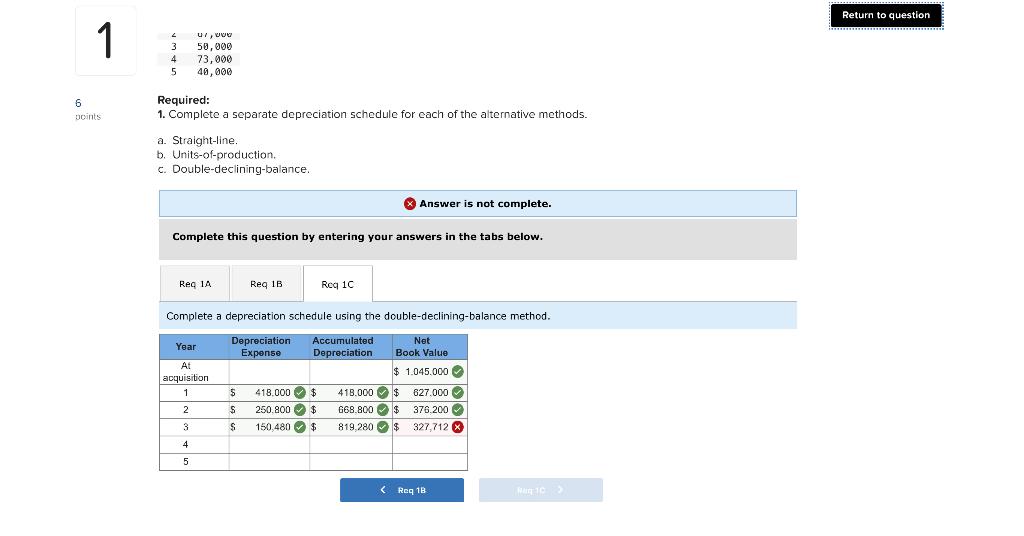

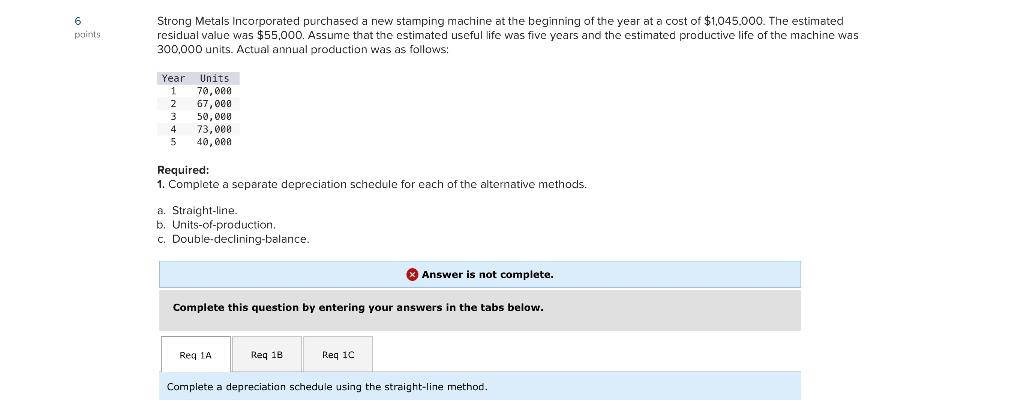

Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. x Answer is not complete. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the double-declining-balance method. Strong Metals Incorporated purchased a new stamping machine at the beginning of the year at a cost of $1,045,000. The estimated residual value was $55,000. Assume that the estimated useful life was five years and the estimated productive life of the machine was 300,000 units. Actual annual production was as follows: Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Answer is not complete. Complete this question by entering your answers in the tabs below. Complete a depreciation schedule using the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts