Question: Student digit Number is 5 54 5. Binomial Options Pricing 10 marks Using the last digit of your student number, select the appropriate scenario from

Student digit Number is 5

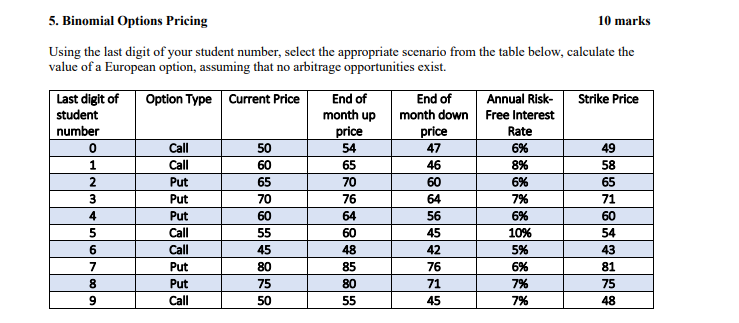

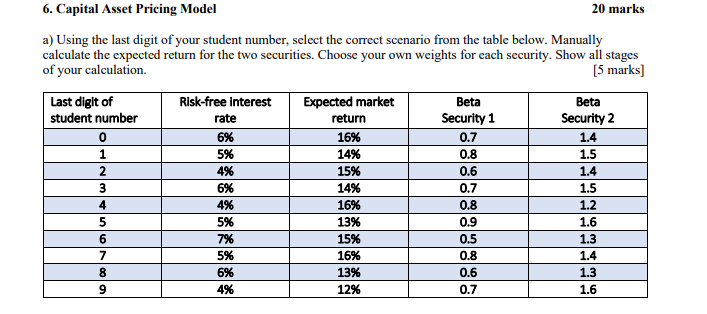

54 5. Binomial Options Pricing 10 marks Using the last digit of your student number, select the appropriate scenario from the table below, calculate the value of a European option, assuming that no arbitrage opportunities exist. Last digit of Option Type Current Price End of End of Annual Risk- Strike Price student month up month down Free Interest number price price Rate 0 Call 50 47 6% 49 1 Call 60 65 46 8% 58 2 Put 65 70 60 6% 65 3 Put 70 76 64 7% 71 4 Put 60 64 56 6% 60 5 Call 55 60 45 10% 54 6 Call 45 48 42 5% 43 7 80 85 76 6% 81 8 Put 75 80 71 7% 75 9 Call 50 55 45 7% 48 Put 6. Capital Asset Pricing Model 20 marks a) Using the last digit of your student number, select the correct scenario from the table below. Manually calculate the expected return for the two securities. Choose your own weights for each security. Show all stages of your calculation. [5 marks] Beta Security 1 0.7 0.8 0.6 Last digit of student number 0 1 2 3 4 5 6 7 8 0.7 Risk-free interest rate 6% 5% 4% 6% 4% 5% 7% 5% 6% 4% Expected market return 16% 14% 1596 1496 16% 13% 15% 16% 13% 12% Beta Security 2 1.4 1.5 1.4 1.5 1.2 1.6 1.3 1.4 1.3 1.6 0.8 0.9 0.5 0.8 0.6 0.7 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts