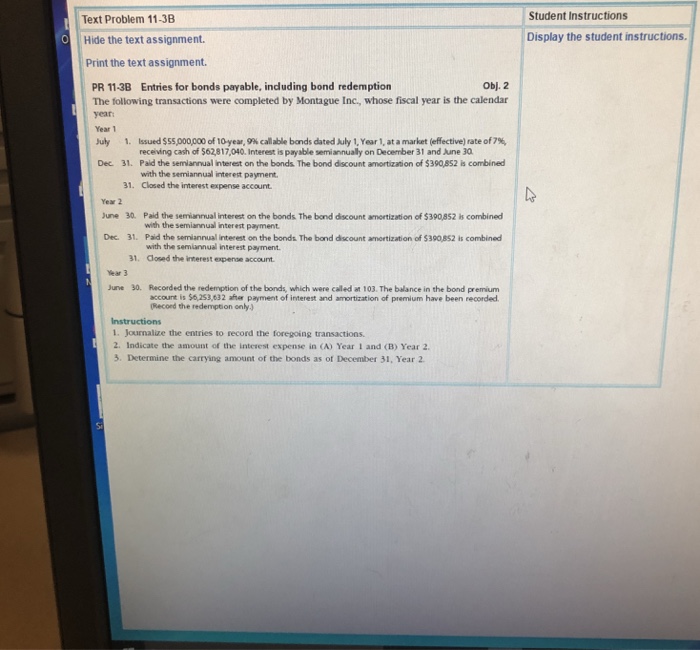

Question: Student Instructions Text Problem 11-3B Hide the text assignment. Print the text assignment. Display the student instructions. PR 11-3B Entries for bonds payable, induding bond

Student Instructions Text Problem 11-3B Hide the text assignment. Print the text assignment. Display the student instructions. PR 11-3B Entries for bonds payable, induding bond redemption Obj. 2 The following transactions were completed by Montague Inc, whose fiscal year is the calendar year Year 1 July Issued SSS,000,000 of 10year, 9% callable bonds dated July 1. Year 1, at a market (effective) rate of 7% receiving cash of $62,817,040.Interest is payable semiannually on December 31 and June 30 1. Dec. 31. Pald the semiannual interest on the bonds The bond discount amortization of $390,852 is combined with the semiannual interest payment 31. Closed the interest expense account Yeaw 2 une 30. Paid the semiannual interest on the bonds The bond discount amortization of $390,852 is combined with the semiannual interest payment Dec. 31. Paid the semiannual Interest on the bonds The band discount amortization of $390,852 is combined with the semiannual interest payment 31. dlosed the interest esxpenoe account Year 3 Recorded the redemption of the bonds, which were called at 103. The balance in the bond premium account is $6,253,632 aher payment of interest and amortization of premium have been recorded (Recoed the redemption only) June 30. 1. Journalize the entries to record the foregoing transactions 2. Indicate the amount of the interest expense in (A) Year I and (B) Year 2 3. Determine the carrying amount of the bonds as of December 31, Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts