Question: Student instructions: Use the forecasting variables below to complete the Weighted Average Cost of Capital (WACC) at different break points. Use the same WACC that

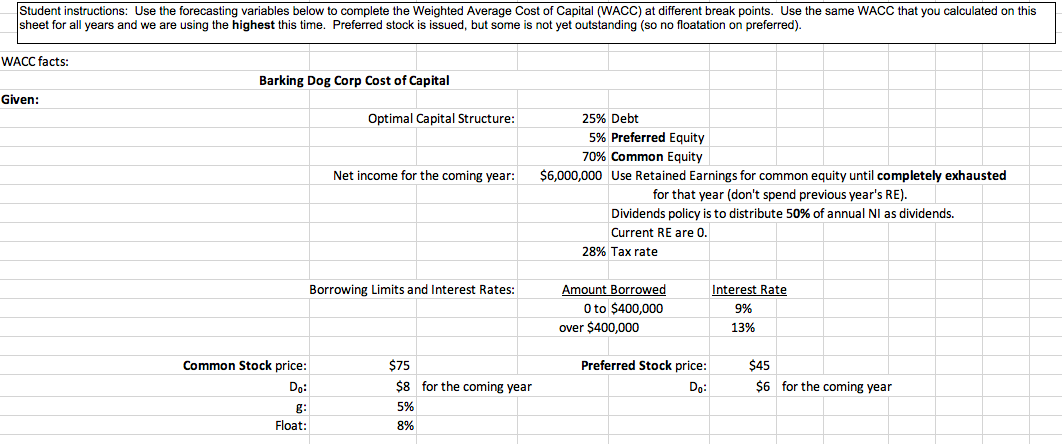

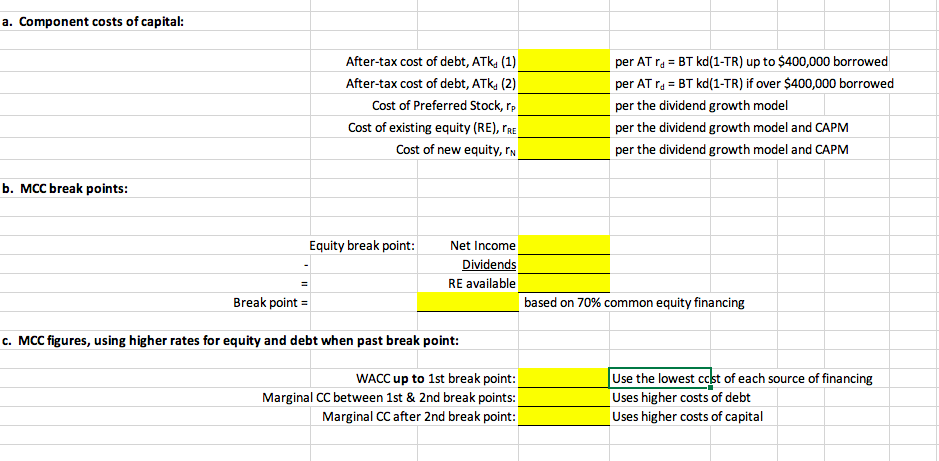

Student instructions: Use the forecasting variables below to complete the Weighted Average Cost of Capital (WACC) at different break points. Use the same WACC that you calculated on this sheet for all years and we are using the highest this time. Preferred stock is issued, but some is not yet outstanding (so no floatation on preferred). WACC facts: Given: Barking Dog Corp Cost of Capital \begin{tabular}{|l|r|} \hline Optimal Capital Structure: & 25% Debt \\ \hline & 5% Preferred Equity \\ \hline 70% Common Equity \end{tabular} Net income for the coming year: $6,000,000 Use Retained Earnings for common equity until completely exhausted for that year (don't spend previous year's RE). Dividends policy is to distribute 50% of annual NI as dividends. Current RE are 0. 28% Tax rate Borrowing Limits and Interest Rates: Common Stock price: \begin{tabular}{|c|c|} \hline Amount Borrowed & Interest Rate \\ \hline 0 to $400,000 & 9% \\ \hline over $400,000 & 13% \\ \hline \end{tabular} a. Component costs of capital: \begin{tabular}{|c|l} \hline After-tax cost of debt, ATk d (1) & per AT rd= BT kd(1-TR) up to $400,000 borrowed \\ \hline After-tax cost of debt, ATk \\ \hline Cost of Preferred Stock, rp & per AT rd= BT kd(1-TR) if over $400,000 borrowed \\ Cost of existing equity (RE), rRE & per the dividend growth model \\ \hline Cost of new equity, rN & per the dividend growth model and CAPM \\ \hline \end{tabular} b. MCC break points: c. MCC figures, using higher rates for equity and debt when past break point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts